Global Markets Recap - Week of August 14, 2023

1. What Moved the Markets?

Europe

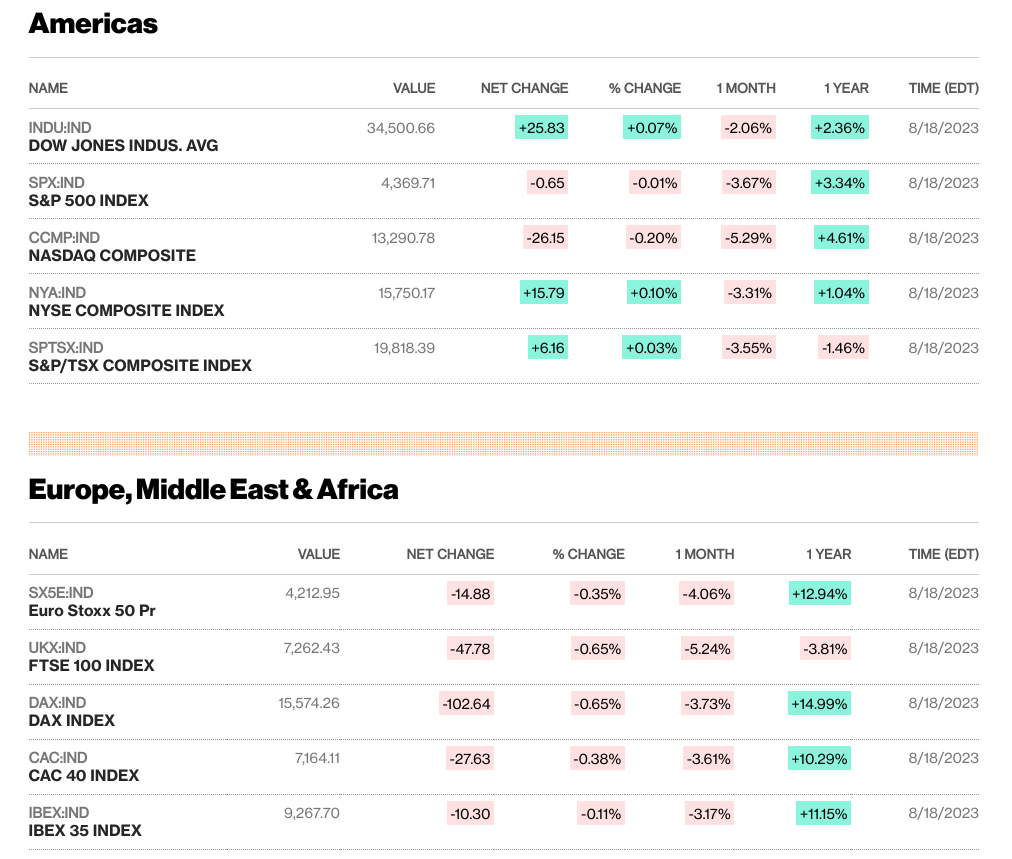

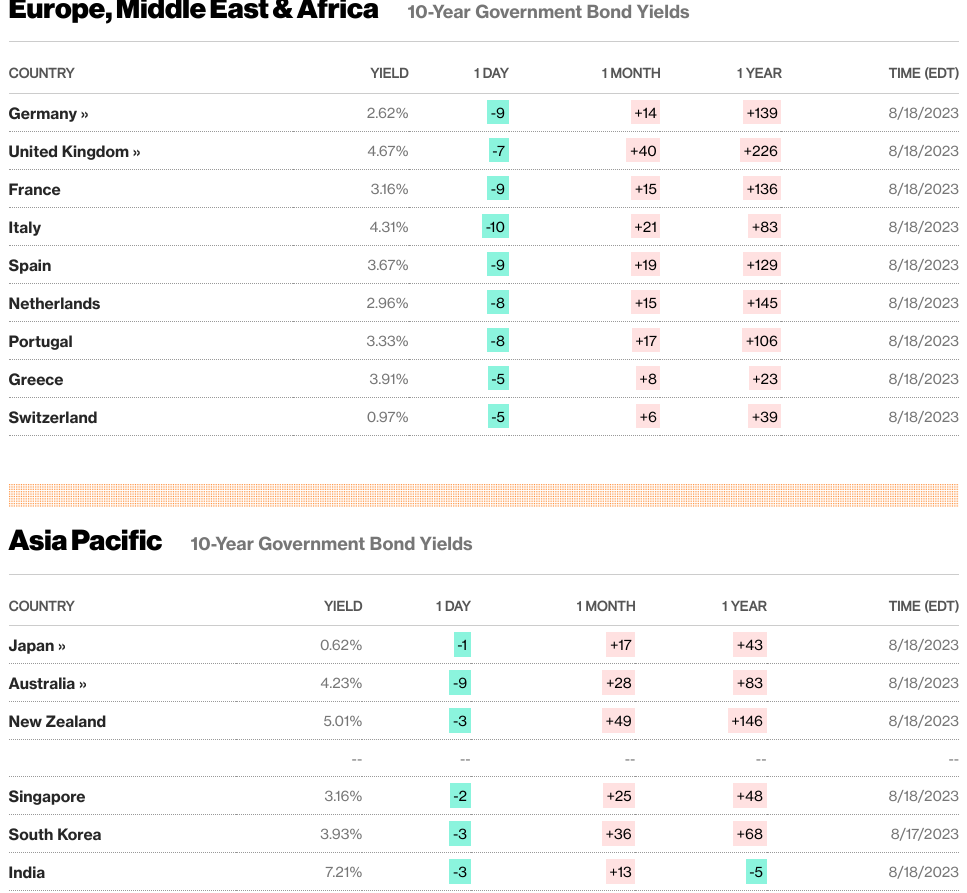

The STOXX Europe 600 Index dropped 2.34% due to concerns about China's economy and higher European interest rates. Major indices also fell: France's CAC 40 by 2.40%, Germany's DAX by 1.62%, Italy's FTSE MIB by 1.81%, and the UK's FTSE 100 by 3.48%.

In the UK, strong wage growth increased pressure on the Bank of England (BoE) for more rate hikes. Weekly earnings (excluding bonuses) rose 7.8% in June, up from 7.4% in May. However, the labor market cooled as the unemployment rate rose unexpectedly to 4.2% from 3.9%.

UK's annual inflation slowed to 6.8% in July from 7.9% in June due to lower energy and food prices. Core inflation, excluding certain items, remained at 6.9%. Service prices, a key indicator for BoE, accelerated to 7.4%, the highest since March 1992.

In Norway, the central bank raised its benchmark rate by 0.25% to 4.0%, hinting at another increase in September, as signaled by Norges Bank Governor Ida Wolden Bache.

US

Stocks declined for a third week due to rising bond yields and China concerns. The S&P 500 fell 5.15% from July's peak. Growth stocks held up better than value, while small caps suffered. Despite rising rates affecting future earnings, growth shares fared relatively better compared to value stocks. Small-cap stocks performed the weakest, with market fluctuations possibly intensified by program trading, technical factors, and low summer trading activity.

Strong retail sales rose 0.7% in July, with discretionary spending evident. Economic indicators suggested a potential smooth landing for the economy.

The Federal Reserve's July meeting minutes raised concerns about its response to ongoing growth signals. While expressing optimism for a gradual reduction in GDP growth, investors perceived a generally hawkish tone.

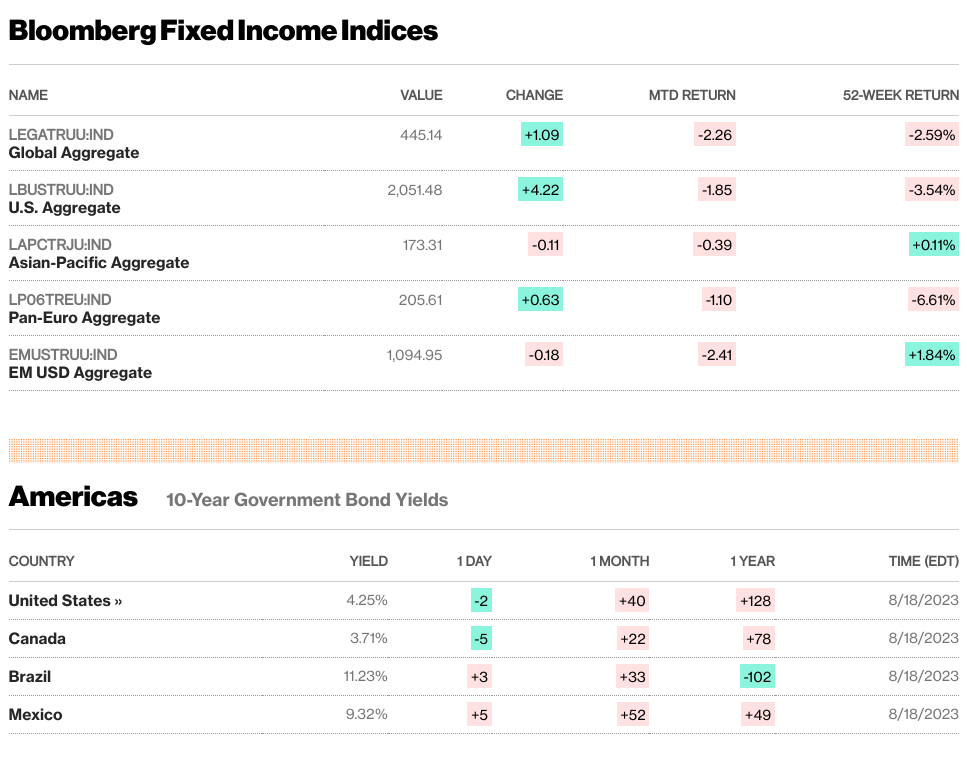

Post the meeting, economic growth projections became murkier. The Atlanta Fed's GDPNow forecast surged to 5.8% for the current quarter, exceeding Q2's 2.4% growth. Economists in the "Blue Chip" survey revised their growth predictions upward. However, rate hike expectations, gauged by the CME FedWatch tool, remained stable. The benchmark 10-year U.S. Treasury yield reached its highest level since October 2022, driven by economic surprises and supply concerns.

Investment-grade corporate bonds lagged, while high yield issuance delayed until after Labor Day.

Japan

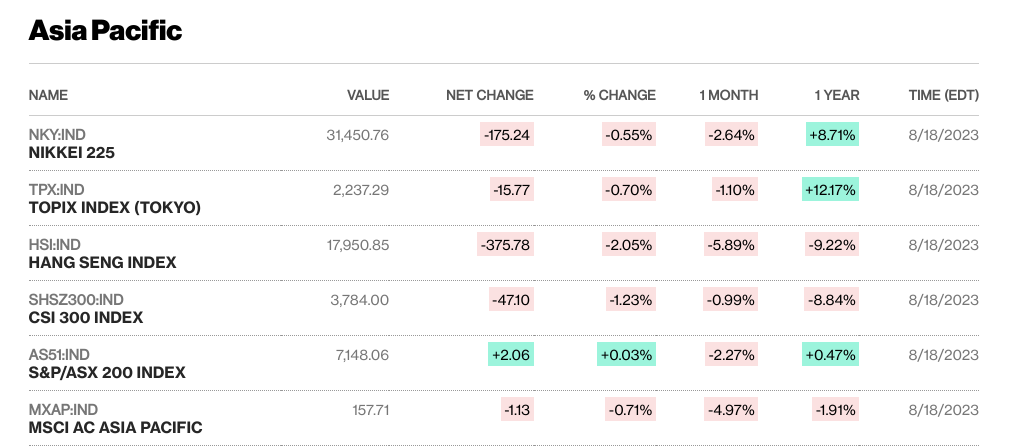

Concerns about China's macroeconomic weakness and its property sector troubles led to declines in Japan's stock markets. The Nikkei 225 Index fell by 3.2%, while the broader TOPIX Index dropped by 2.9%. Notably, tourism-related stocks experienced share price declines.

The yield on the 10-year Japanese government bond (JGB) increased to 0.64% from the previous week's 0.58%. This follows the Bank of Japan's monetary policy adjustment in July, allowing JGB yields to rise more freely by shifting its 0.5% yield ceiling from a strict limit to a reference point.

The yen weakened to around JPY 145.5 against the U.S. dollar from the previous week's JPY 144.9, nearing nine-month lows that prompted intervention in September 2022. Japan's Finance Minister emphasized vigilance over market moves, particularly speculative actions affecting companies and households.

Surprisingly, Japan's GDP expanded by 6.0% quarter on quarter in Q2 2023, surpassing the 2.9% forecast. External demand drove growth, with exports benefiting from historic yen weakness, offsetting domestic demand weaknesses, including lower private consumption due to rising prices.

In July, Japan's consumer price inflation slightly slowed but remained high at 3.1% year on year, exceeding the BoJ's 2% target for the 16th consecutive month. Exports experienced a 0.3% year on year decline, the first in over two years, driven by weak demand from Asia, while Western markets saw stronger growth. Imports fell 13.5% year on year due to easing commodity prices.

China

Amid concerns about China's slowing economic recovery, Chinese stocks faced losses. The Shanghai Stock Exchange Index declined by 1.80%, and the CSI 300 dropped by 2.58%. In Hong Kong, the Hang Seng Index saw its largest weekly drop in five months, plummeting by 5.89%.

Official data for July indicated a continued weakening in China's economic activity. Industrial output and retail sales grew slower than expected year-on-year. Fixed asset investment growth for the first seven months of 2023 also fell short of forecasts. Urban unemployment slightly increased to 5.3% from June's 5.2%, while youth unemployment rates, which had been rising, were not released, causing concerns about suppressed sensitive information.

China's property market downturn was underscored by a decline in new home prices in 70 major cities. July saw a 0.23% drop from June, marking the first decline in 2023. Despite initial signs of stabilization, recent developments revived worries about the sector's recovery. Leading property developer Country Garden suspended bond trading after missing interest payments, and China Evergrande, a major developer, filed for bankruptcy protection in the U.S. amid debt restructuring efforts.

In a surprise move, the People's Bank of China lowered its medium-term lending facility rate by 15 basis points to 2.5%, the largest cut since 2020, due to weak demand. The central bank also decreased the seven-day reverse repurchase rate by 10 basis points in an attempt to address the economic challenges.

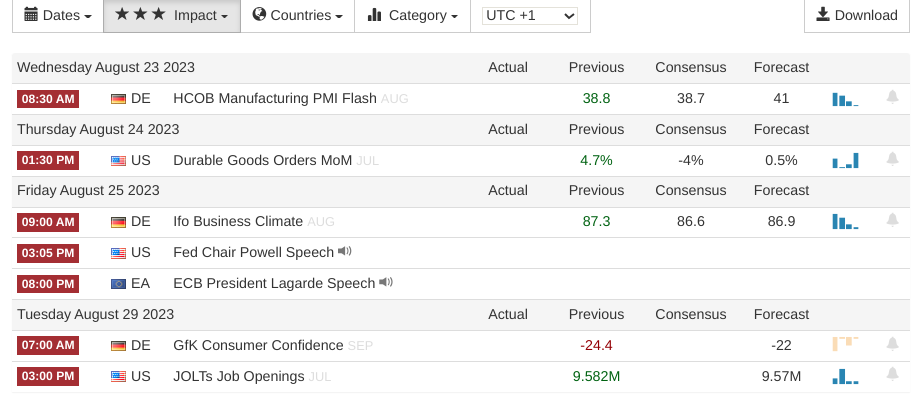

2. Week Ahead