Global Markets Recap - Week of July 24, 2023

1. What Moved the Markets?

Europe

In a highly eventful week for economic data and news, European markets showcased their resilience and potential for growth, as several key indices posted significant gains. Euro Stoxx 50 Pr: +0.43%, FTSE 100: +0.02%, DAX: +0.39%, CAC 40: +0.15%, IBEX 35: -0.10%d, reflecting a positive sentiment among investors.

Despite interest rate increases by both the Federal Reserve and the European Central Bank (ECB), the overall tone struck by policymakers was notably dovish, providing a boost to investor confidence. Additionally, encouraging reports from China, hinting at further support for their economy, served as a catalyst for market optimism.

Bond yields within the Eurozone experienced volatility, driven by concerns over the possibility of higher Japanese yields leading to a potential exodus of Japanese investors from the market. However, yields steadied towards the end of the week, with German 10-year sovereign bond yields touching around 2.56% before settling at approximately 2.49%. Likewise, UK government bond yields closed the week on a higher note.

Amidst the economic developments, Spain faced political uncertainty after an inconclusive election outcome, which may result in coalition negotiations or even a subsequent election. Simultaneously, Eurozone business activity exhibited signs of slowdown, with the Flash Eurozone Composite PMI Index dipping to an eight-month low in July. Germany's IFO business climate index also recorded its third consecutive monthly decline. In contrast, the UK business sentiment index displayed positive results for the three months leading up to July.

The ECB raised interest rates to 3.75%, driven by concerns about euro area inflation persisting at elevated levels. However, the central bank hinted at the possibility of a pause in monetary tightening, suggesting a cautious approach in future rate decisions.

As annual inflation in the euro area remained at 5.5% in June, with preliminary July inflation readings in France and Spain providing mixed signals, investors are keenly observing central banks' policy maneuvers and the implications for market trends.

US

Stocks ended the week on a positive note, with the Dow Jones Industrial Average recording its 13th consecutive daily gain, the longest streak since 1987. YTD (%) DJIA: 6.98%, S&P 500: 19.34%, Nasdaq Composite: 36.79%, S&P MidCap 400: 11.79%, Russell 2000: 12.51%. The market showed resilience despite subdued trading due to summer vacations and focus on important data releases, the Fed's policy meeting (another 25bps rate hike as expected), and corporate earnings reports.

Investor sentiment received a boost from positive economic readings, especially on inflation. The core personal consumption expenditures (PCE) price index rose 0.2% in June, slightly below expectations, while the employment cost index increased by 1.0% in the second quarter, alleviating concerns about wage inflation.

Economic data hinted at a potential soft landing for the economy, with encouraging growth rates reported by the Commerce Department. Businesses and consumers seemed to remain in good shape, supporting the market's optimism.

Following the Fed's policy meeting, a 0.25% increase in the federal funds target rate was announced, but the tone of the statement hinted at a potential pause in further rate hikes in 2023. U.S. Treasury yields ticked down on reassuring inflation data.

While the investment-grade corporate bond market tightened spreads, riskier bonds faced pressure after the Bank of Japan's yield curve control policy announcement. High-yield securities were affected as risk assets dipped.

The week showcased cautious optimism, and investors remained attentive to economic indicators and Fed signals.

Japan

Japanese stock markets saw positive movements during the week, with the Nikkei 225 Index climbing 1.4% and the broader TOPIX Index gaining 1.3%. The Bank of Japan (BoJ) surprised investors with adjustments to its monetary policy, raising its forecast for consumer price inflation in fiscal 2023.

In response, the yield on the 10-year Japanese government bond (JGB) rose to 0.55%, reaching a nine-year high, driven by the BoJ's policy tweak and expectations of further normalization. The yen also strengthened against the U.S. dollar, trading at around JPY 139.8 compared to the previous week's JPY 141.8.

The BoJ's key short-term interest rate remained unchanged at -0.1%, but it introduced greater flexibility in yield curve control (YCC) to sustain monetary easing. The central bank will allow 10-year JGB yields to fluctuate within a range of around plus and minus 0.5% from the zero percent target level, considering the upper and lower bounds as references, not rigid limits, in its market operations. Additionally, the BoJ will conduct fixed rate purchase operations, buying 10-year JGBs at 1.0% daily, up from the previous 0.5%.

In its Outlook for Economic Activity and Prices, the BoJ maintained its projected real economic growth rates, expecting a 1.3% year-on-year expansion of gross domestic product in fiscal 2023. Notably, the central bank raised its forecast for the consumer price index (CPI) in fiscal 2023 to 2.5% year-on-year, a significant upward revision from the previous estimate of 1.8%. This revision was largely driven by cost increases, particularly the pass-through of past import price rises to consumer prices. The BoJ's CPI forecasts for fiscal 2024 and fiscal 2025 remained relatively stable at +1.9% and +1.6%, respectively.

China

Chinese equities surged on stimulus signals, with the Shanghai Stock Exchange Index up 3.42% and the CSI 300 gaining 4.47%. The Hang Seng Index in Hong Kong rose 4.41%.

The Communist Party's Politburo pledged to boost domestic consumption and support the real estate sector. Economists revised down China's GDP growth forecasts to 5.2% this year and 4.8% in 2024.

Pan Gongsheng was appointed as the governor of the People's Bank of China, following his earlier appointment as the Communist Party's secretary at the central bank.

Meanwhile, industrial profits declined 8.3% in June, showing some improvement from May, but concerns about potential deflation persist. The figures underscore the need for sustained efforts to stimulate economic activity and ensure a stable recovery in China's industrial landscape.

The market response to the stimulus signals has been positive, but economists continue to monitor key indicators and policy developments to gauge the overall trajectory of China's economic recovery.

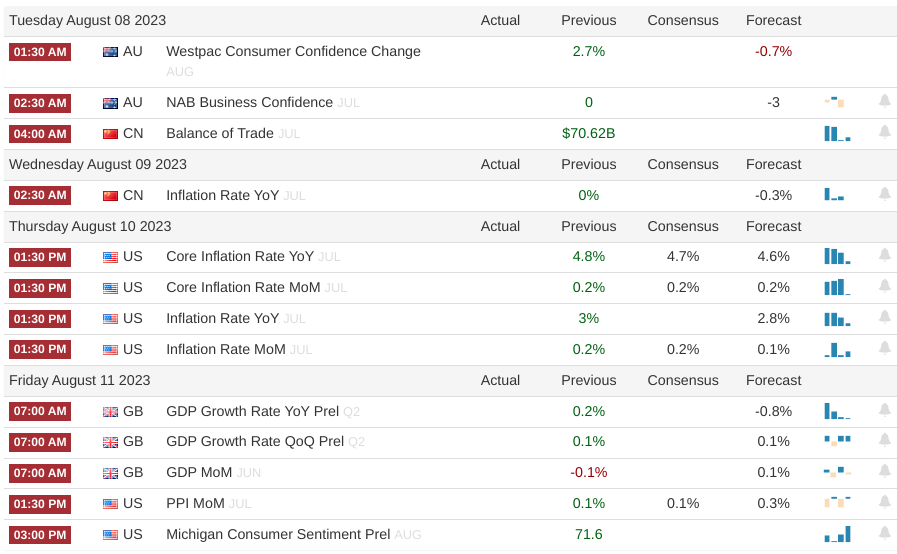

2. Week Ahead