Global Markets Recap - Week of July 3, 2023

1. What Moved the Markets?

Europe

In local currency terms, the STOXX Europe 600 Index declined by 3.09% due to concerns about tightening monetary policy by central banks. Disappointing economic data from Germany, including industrial production, factory orders, and exports, indicated ongoing weakness in the second quarter. Major European stock indexes also experienced losses, with Germany's DAX down 3.37%, France's CAC 40 Index sliding 3.89%, Italy's FTSE MIB dropping 1.60%, and the UK's FTSE 100 Index falling 3.65%.

European government bond yields increased, with the yield on the benchmark German 10-year bond exceeding 2.6%. French and Italian bond yields also rose, while UK yields reached their highest levels since mid-2008.

In the eurozone, factory gate prices fell 1.9% sequentially in May, primarily driven by lower energy costs. Retail sales volumes remained flat for the second consecutive month, with increased spending on non-food items offsetting declines in food and automotive fuel sales. Consumer inflation expectations for the next 12 months decreased further, with participants in the ECB's survey anticipating inflation at 3.9% in a year's time.

ECB President Christine Lagarde maintained a hawkish stance, stating that more work needs to be done to reduce inflation, which is projected to remain above the 2% target in 2024 and 2025.

In the UK, rising mortgage rates contributed to a sharp decline in house prices, with a 2.6% year-over-year fall reported by home loan provider Halifax. This marked the largest decline since 2011.

US

Stocks closed lower in a relatively quiet week, attributed to the holiday-shortened trading week and anticipation of second-quarter earnings reports. Growth stocks performed slightly better than value shares. Positive sales reports from Tesla and Rivian boosted the electric vehicle sector, while disappointing trial results for AstraZeneca's lung cancer drug weighed on healthcare stocks. The release of the Federal Reserve's meeting minutes revealed a more hawkish outlook, with some members expressing a preference for a rate increase. Dallas Fed President Lorie Logan indicated the possibility of two more rate hikes this year. However, market expectations for rate hikes decreased following a slowdown in the job market, as job gains fell below expectations and the unemployment rate edged down. The manufacturing sector showed a contraction in hiring, while the services sector saw an expansion in employment. The benchmark 10-year U.S. Treasury yield fluctuated but closed the week higher, surpassing 4% for the first time in eight months. Municipal bonds fared better, supported by reinvestments and limited supply, while credit-sensitive corporate bond markets remained quiet during the holiday-shortened week.

Japan

Japan's stock markets experienced losses, with the Nikkei 225 Index falling by 2.4% and the TOPIX Index down 1.5%. The retreat from 33-year highs was driven by profit-taking, particularly in technology stocks, as investors anticipated potential interest rate hikes by the U.S. Federal Reserve. However, the Bank of Japan's accommodative monetary policy and the weakened yen provided some support to export-oriented firms.

Speculation regarding changes in the Bank of Japan's yield curve control policy led to an increase in the yield on the 10-year Japanese government bond (JGB). However, BoJ Deputy Governor Shinichi Uchida stated that the central bank would maintain its current yield curve policy, acknowledging the side effects but emphasizing the need to support the economy.

The Japanese yen strengthened against the U.S. dollar, reaching around JPY 143, as expectations for BoJ intervention in the foreign exchange market diminished. Japanese and U.S. authorities were reported to be in close contact regarding currency movements.

There were signs of wage growth as nominal wages in Japan rose by 2.5% year-on-year in May, surpassing expectations. However, real wages remained a concern, impacting household consumption. The Bank of Japan is closely monitoring wage growth and aims for sustainable increases as part of achieving its 2% inflation target.

Overall, while Japan's stock markets faced losses, the BoJ's monetary policy and yen weakness helped mitigate the impact. Wage growth and currency movements remained important factors to watch for future economic developments.

China

Chinese equities faced a decline as concerns arose over the country's sluggish post-pandemic recovery. The Shanghai Stock Exchange Index fell by 0.17%, while the CSI 300 blue chip index dropped 0.44%. In Hong Kong, the Hang Seng Index experienced a significant plunge of 2.91%.

The private Caixin/S&P Global survey revealed a slowdown in manufacturing activity, with the index easing to 50.5 in June from May's 50.9. This indicated a softening in manufacturing output and new orders. The Caixin services activity survey also decreased to a lower-than-expected 53.9 in June from 57.1 in May, marking the sixth consecutive month of expansion but the lowest reading since January. These weak data align with the official Manufacturing Purchasing Managers' Index, which contracted for the third consecutive month in June.

Chinese Premier Li Qiang pledged to swiftly implement targeted policies to bolster the country's post-pandemic recovery. Li emphasized the critical stage of economic recovery and the need for comprehensive measures to stabilize growth and employment. However, no specific details regarding these measures were provided.

In central bank news, Pan Gongsheng, the deputy governor of the People's Bank of China, was appointed as the top Communist Party official at the central bank. This move positions Pan to potentially become the next governor of the central bank. Economists interpreted the appointment as reinforcing policy stability, aligning with the current approach of modest interest rate cuts and increased lending to targeted areas.

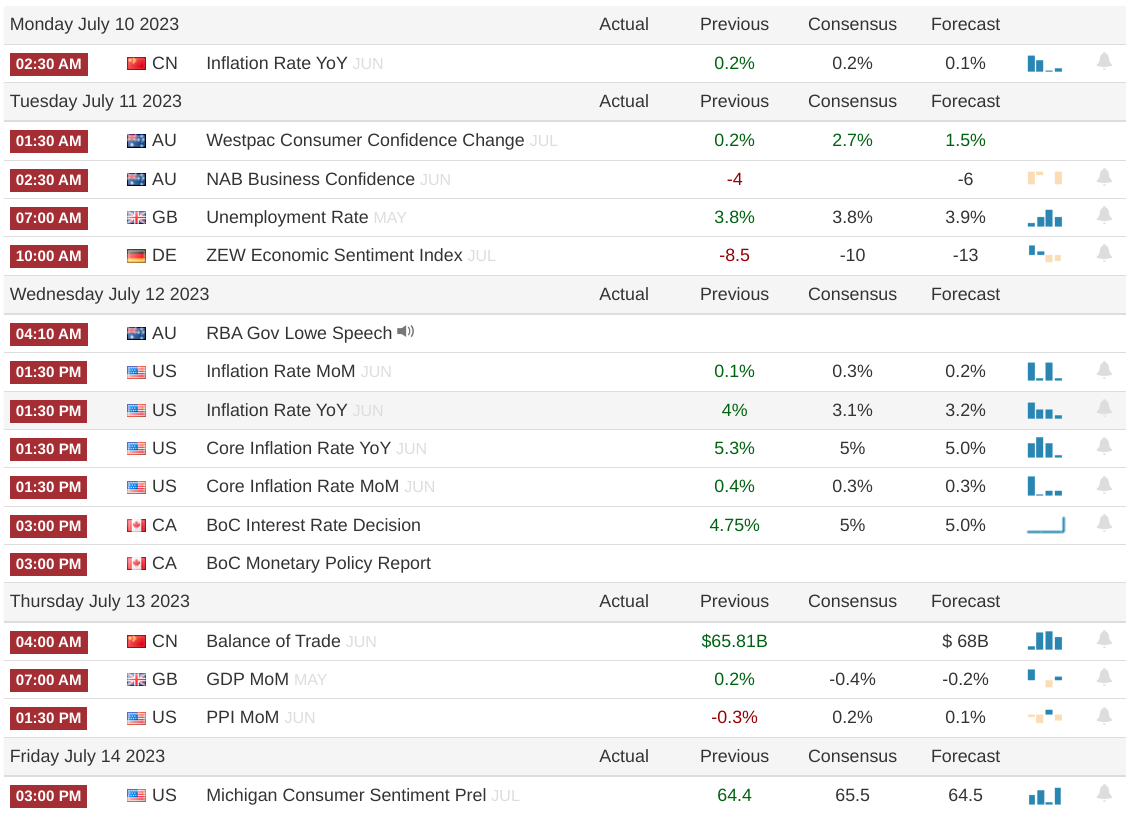

2. Week Ahead