Global Markets Recap - Week of July 31, 2023

1. What Moved the Markets?

Europe

The pan-European STOXX Europe 600 Index closed -2.44% lower as higher U.S. bond yields and disappointing European earnings reports dampened investor enthusiasm for riskier assets. Major country stock indexes, including Germany's DAX (-3.14%), France's CAC 40 Index (-2.16%), Italy's FTSE MIB (-3.10%), and the UK's FTSE 100 Index (-1.69%) also experienced declines.

European government bond yields saw a widespread increase as positive economic data hinted at the possibility of avoiding a global recession. Specifically, the yield on the benchmark 10-year German government bond rose to its highest levels since March. In the UK, the yield on the benchmark 10-year government bond stabilized below 4.5% following the Bank of England's 14th consecutive increase in borrowing costs.

The Bank of England (BoE) raised its key interest rate to 5.25% and predicted inflation to fall to 4.9% by year-end. The UK housing market remained weak with house prices falling and mortgage lending contracting. Eurozone inflation slowed to 5.3% in July, but the economy rebounded by 0.3% in Q2, despite forward-looking indicators signaling a weaker start to Q3.

US

Major U.S. equity benchmarks had a down week in August following a strong July, mainly due to rising Treasury yields and an unexpected downgrade of the U.S. government's credit rating. The tech-heavy Nasdaq suffered the most in the week. As of the latest close, the YTD% changes for major indices: DJIA 5.79%, S&P 500 16.63%, Nasdaq Composite 32.89%, S&P MidCap 400 10.34%, and Russell 2000 11.12%.

We were deep in the earnings season. Amazon's impressive earnings beat boosted its stock, while Apple faced some challenges with mixed results. Amazon's performance surpassed expectations, driven by the robustness of its core retail business, leading to a remarkable stock rally of over 9% at Friday's opening. On the other hand, Apple faced a different outcome, with its stock declining around 3% following a mixed report. While the services business showed strength, iPhone sales fell short of expectations.

The U.S. government's credit rating was downgraded by Fitch Ratings from AAA to AA+ due to fiscal challenges. Hiring showed a slowdown in July compared to the start of the year. In July, the Labor Department's nonfarm payroll report showed the addition of 187,000 jobs, similar to the revised figure for June (185,000). The data for the past two months indicate a noticeable slowdown compared to the strong job growth seen in the first five months of the year, which averaged 287,000 jobs per month. The unemployment rate declined from 3.6% to 3.5%, and wages grew at a consistent rate of 4.4% over the 12-month period, unchanged from June.

Treasury yields increased, impacting the municipal and corporate bond markets. The yield on the 10-year U.S. Treasury note rose from 3.95% at the previous week's close to approximately 4.20% by early Friday, but it dropped to 4.05% after the jobs report was released. Expectations of increased Treasury Department issuance contributed to the earlier rise in yields. As a result, the tax-exempt municipal bond market began August with a weaker performance, mirroring the sell-off in Treasuries.

In the investment-grade corporate bond sector, issuance was oversubscribed throughout the week. However, the high yield corporate bond market traded lower due to Fitch's downgrade of U.S. debt, leading to broad risk-off sentiment. Despite this, the primary market remained active, with several new deals announced. Investors showed some selectivity, resulting in tepid demand for a few issues, while higher-quality deals continued to trade well.

Japan

Despite a strong corporate earnings season domestically, Japan's stock markets experienced declines due to global investor risk aversion triggered by a U.S. sovereign credit rating downgrade. The Nikkei 225 Index lost 1.7%, and the broader TOPIX Index was down 0.7%. The 10-year Japanese government bond yield rose to around a nine-year high of 0.65% after the Bank of Japan's (BoJ) July monetary policy adjustment, which increased flexibility around its yield curve control target. The BoJ's commitment to its accommodative stance and Japan's wide interest rate differential with the U.S. contributed to the weakening of the yen against the U.S. dollar. Despite the expanding services sector, Japan's sluggish manufacturing industry continued to face challenges with a decline in output and new orders.

Following a monetary policy adjustment, the yield on the 10-year Japanese government bond (JGB) increased to 0.65%, reaching a nine-year high from 0.55% at the previous week's end. This adjustment was made after the Bank of Japan's (BoJ) decision to allow interest rates to rise more flexibly. The BoJ increased the flexibility around its yield curve control target and raised its daily offer to buy 10-year JGBs to 1.0% from 0.5%. To mitigate the speed of yield gains, the BoJ also conducted two unscheduled bond-purchase operations during the week. BoJ Governor Kazuo Ueda expressed his belief that yields would not rise to 1% under the current circumstances, reiterating the BoJ's commitment to its accommodative stance. Due to this commitment and Japan's wide interest rate differential with the U.S., the yen weakened against the U.S. dollar, trading around JPY 142.6 compared to approximately 141.1 the previous week. There were speculations that Japan's Ministry of Finance might intervene in the foreign exchange markets to bolster the yen's value.

In July, the services sector expansion in Japan slowed according to the latest Purchasing Managers' Index (PMI) data compiled by au Jibun Bank. The headline services index declined to 53.8 in July from 54.0 in June. However, business activity and new business growth rates remained solid overall, despite softening compared to the previous month. Notably, there was a surge in foreign demand for Japanese services, driven by strong demand for travel and tourism from abroad. In contrast, the manufacturing PMI slipped further into contraction territory, falling to 49.6 in July from 49.8 the prior month. Both output and new orders experienced modest declines, mainly due to weak demand for manufactured goods in both domestic and international markets.

China

Chinese stocks saw a rise as Beijing's supportive stance countered concerns over disappointing economic data. The Shanghai Stock Exchange Index gained 0.37%, and the CSI 300 advanced 0.7%.

In an effort to boost consumption, China's State Council introduced new measures, including removing restrictions on sectors like autos, real estate, and services. While subsidies for home appliances and renovation materials in rural areas were encouraged, the measures did not include direct cash support to consumers.

The People's Bank of China (PBOC) pledged support for the real estate market, intending to reduce housing loan interest rates and down payment ratios, and guide commercial lenders to adjust rates on existing mortgages. Speculation arose regarding a possible cut in the reserve requirement ratio for domestic lenders as the government aims to strengthen China's economic recovery.

China's official manufacturing Purchasing Managers' Index (PMI) for July met expectations, reaching 49.3 from June's 49, but remained below the growth threshold for the fourth consecutive month. The non-manufacturing PMI, however, declined to 51.5, falling short of expectations. The private Caixin/S&P Global manufacturing activity survey also contracted in July, while the Caixin services activity survey unexpectedly improved.

The property sector faced further challenges, with new home sales by China's top 100 developers falling 33.1% in July compared to the previous year, extending a two-month decline despite government efforts to support the sector since December.

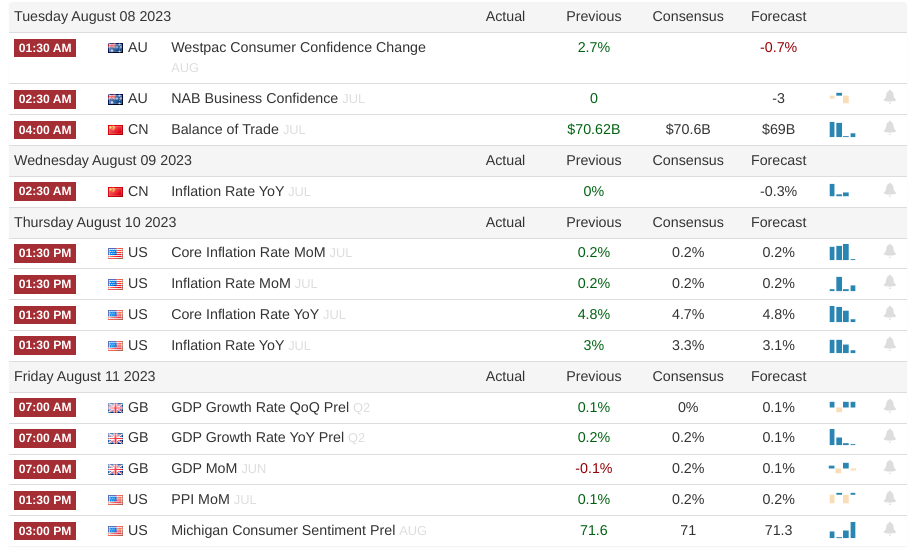

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)