Global Markets Recap - Week of June 12, 2023

1. What Moved the Markets?

Europe

The pan-European STOXX Europe 600 Index rallied (1.47%) as the US Federal Reserve kept interest rates unchanged, and hopes of stimulus measures in China boosted stocks. Major equity indexes in Germany (2.56%), France (2.43%), Italy (2.58%), and the UK (1.06%) also advanced. The German government bond yield rose after the European Central Bank (ECB) raised interest rates and signaled further tightening. Short-term UK gilt yields surged following higher-than-expected wage growth, raising expectations of increased borrowing costs.

The ECB raised its key deposit rate, stating that they have more ground to cover and are likely to tighten borrowing costs again in July. The ECB also revised its inflation forecasts upward while lowering economic growth estimates.

The German 10-year rate went above 2.5%. Industrial production in the eurozone rebounded, and German investor sentiment improved in June. Swiss and French bond yields also experienced an upward trend, while short-term UK government bond yields skyrocketed to their highest levels since 2008. This surge was triggered by data revealing that UK wages surpassed expectations in April, leading to heightened anticipation of an additional rise in borrowing expenses.

The UK economy showed growth in April, supporting expectations of the Bank of England (BoE) continuing to raise interest rates. Wage growth was higher than expected, and the unemployment rate decreased. BoE Governor Andrew Bailey stated that the labor market remains tight, and although inflation is expected to decrease, it is taking longer than anticipated.

US

The stock market rally continued, with favorable signals of inflation and growth calming investors' fears. The S&P 500 Index experienced its longest stretch of daily gains since November 2021 and its best weekly performance since March. Growth stocks and large-caps outperformed, although the market's advance narrowed. The consumer price index showed inflation at its lowest level since late 2021, indicating a "Goldilocks" expansion with continued growth and falling inflation. Producer prices declined (YoY -4.0%—still double the Federal Reserve’s target, but down MoM -4.9% and the slowest pace since March 2021), influenced by the manufacturing sector contraction and lower food and gasoline prices. Retail sales saw an overall increase, and consumer sentiment reached a four-month high. However, weekly jobless claims remained unchanged. While the Fed maintained the federal funds target rate (5-5.25%), the dot plot revealed a potentially hawkish outlook with projected rate hikes by year-end. The market initially reacted, but Chair Jerome Powell's subsequent press conference had a more dovish tone, emphasizing data dependence. Bond markets remained calm, with limited movements observed, possibly due to the upcoming holiday weekend.

Japan

Japanese stock markets experienced significant gains, with the Nikkei 225 Index rising 4.5% and the TOPIX Index increasing by 3.4%. These gains were supported by the Bank of Japan's decision to maintain its ultra-loose monetary policy, as expected. Positive Japanese export and machinery order data further contributed to market sentiment. However, investors exercised caution due to the US Federal Reserve's indication of potential future rate hikes.

As a result, the yield on the 10-year Japanese government bond (JGB) declined, and the yen weakened against the US dollar, reaching its lowest level in around seven months. The divergence in monetary policies between the Bank of Japan and the Federal Reserve was seen as a factor influencing these trends.

During its June meeting, the Bank of Japan kept its policy settings unchanged, including short-term interest rates and the yield curve control program. The bank's Governor, Kazuo Ueda, acknowledged the potential for surprises in the future given the evolving economic environment. The Bank of Japan faced pressure to adjust its easing stance due to building inflationary pressure but maintained its projection of a slowdown in the consumer price index.

Speculation arose regarding a possible snap election in Japan, but the chance of it happening diminished as a no-confidence motion against Prime Minister Fumio Kishida's Cabinet was submitted but voted down in Parliament. Such motions are common but typically face limited chances of success due to the ruling party's control over the lower house.

China

Chinese stocks experienced a significant surge following the central bank's decision to cut multiple interest rates, raising expectations of further stimulus for industries that are facing a slowdown in the post-pandemic recovery. The Shanghai Stock Exchange Index rose by 1.3%, the blue chip CSI 300 increased by 3.3%, and the Hang Seng Index in Hong Kong rallied by 3.35%.

The People's Bank of China (PBOC) reduced its medium-term lending facility rate by 10 basis points to 2.65%, the first cut since August of the previous year. This move was anticipated after the PBOC unexpectedly lowered the seven-day reverse repurchase rate earlier in the week. Additionally, the central bank injected RMB 237 billion into the banking system to support liquidity. Analysts predict that the PBOC's shift towards stimulus measures may result in targeted support for specific industries as the government aims to strengthen the economic recovery.

Recent indicators have shown a weakening of economic activity in China. Official data revealed slower growth in industrial output, retail sales, and fixed asset investment in May compared to the previous year. Unemployment remained unchanged, but youth unemployment reached a record high in May. Lackluster data in recent weeks has led economists at major banks to revise down their growth forecasts for China in 2023. China is grappling with sluggish export demand, a prolonged slump in the housing market, and weak business and consumer confidence.

The rebound in China's property sector has slowed down, as indicated by a 0.1% increase in new home prices in May, which was slower than the growth rate in April. Data also showed a sharp decline in property investment and sales in May. While the government implemented measures to support cash-strapped developers last year, recent evidence suggests that the recovery momentum in the property sector is waning, leading to calls for additional stimulus.

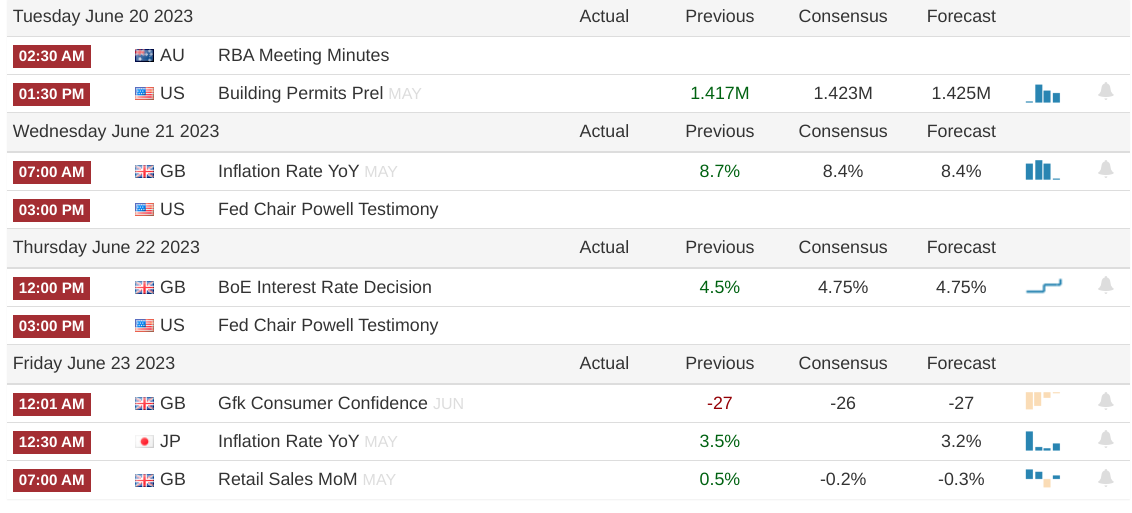

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](https://images.unsplash.com/photo-1657408056887-c8c627f7574a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fHN0YWJsZWNvaW58ZW58MHx8fHwxNzY0NzM0MTExfDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)