Global Markets Recap - Week of June 19, 2023

1. What Moved the Markets?

Europe

European stock markets experienced significant declines amid concerns of potential recession in the UK and the eurozone due to anticipated interest rate increases. Disappointing economic recovery in China and hawkish comments from U.S. Federal Reserve Chair Jerome Powell also contributed to the negative sentiment. Major European stock indexes struggled, with STOXX (-2.93%), Germany's DAX (-3.23%), France's CAC 40 Index (-3.05%), Italy's FTSE MIB (-2.34%), and the UK's FTSE 100 Index (-2.37%) all recording losses.

Recession fears led to lower European government bond yields, with purchasing manager surveys indicating a slowdown in private sector business activity. German, French, and Swiss bond yields declined as a result. The Bank of England (BoE) raised its key interest rate unexpectedly by half a percentage point to 5.0% to combat persistently high inflation. The BoE cited strong inflation data as the reason for the decision, with annual consumer price growth remaining high and core inflation reaching a 31-year high.

In an effort to address inflation, Norway's central bank raised its key interest rate to 3.75% and indicated the likelihood of further rate hikes in August. The Swiss National Bank also increased its benchmark interest rate and did not rule out additional rate increases.

Eurozone business output showed signs of weakness, with the purchasing managers' survey data pointing to a slowing economy after an earlier recovery. German producer prices rose at a slower pace, suggesting a potential easing of inflation. The Ifo Institute predicted a deeper contraction for the German economy in 2023 compared to previous forecasts.

US

During a holiday-shortened trading week, the stock market's winning streak was broken as major benchmarks closed lower. The Nasdaq Composite experienced its first weekly decline (-1.4%) in two months, while the S&P 500 Index recorded its first drop (-1.4%) in six weeks. Growth stocks outperformed value shares, and large-cap stocks fared better than small-cap stocks. The annual rebalance of the Russell indexes on Friday appeared to keep trading volumes muted earlier in the week.

Federal Reserve rate hike expectations weighed on market sentiment. Fed Chair Jerome Powell, in his testimony before Congress, indicated that most policymakers expect interest rates to be raised further by the end of the year. However, futures markets continued to suggest that such rate hikes were unlikely. Rate fears were further intensified by news that the Bank of England and Norges Bank had accelerated their pace of rate hikes.

Economic data during the week raised concerns about tight monetary policy leading to a potential recession. S&P Global reported that U.S. manufacturing activity fell to its lowest level since December, accompanied by suppliers cutting prices in response to weak demand. Weekly jobless claims also reached a high level, although the housing sector showed some strength with housing starts at their highest level in over a year.

In the bond market, longer-term U.S. Treasury yields remained relatively unchanged. Municipal bonds performed well due to strong demand for higher-yielding new issues and the Federal Deposit Insurance Corporation's sale of recently acquired assets from distressed banks. The investment-grade and high-yield corporate bond markets were subdued, while the bank loan market remained calm with collateralized loan obligations generating demand in the secondary market.

Japan

Japanese stock markets retreated from their 33-year highs, with the Nikkei 225 Index falling 2.7% and the TOPIX Index declining 1.6%. Some of the declines were attributed to profit-taking following the strong performance of the markets so far this year. Japan's core consumer inflation data for May, which exceeded expectations, weighed on sentiment and fueled speculation that the Bank of Japan (BoJ) would revise its inflation forecasts upward in July. BoJ board member Seiji Adachi's comments indicated that the central bank's yield curve control policy would likely remain unchanged in the upcoming meeting.

The yield on the 10-year Japanese government bond decreased, reflecting the BoJ's commitment to maintaining ultra-loose monetary policy. This stands in contrast to the tightening stance of other major central banks that are expected to raise rates later in the year. The Japanese yen weakened against the U.S. dollar, approaching levels that prompted intervention from policymakers in the past. Finance Minister Shunichi Suzuki expressed concerns about sharp currency movements and emphasized the importance of stable exchange rates.

Japan's core consumer price index (CPI) rose by 3.2% year on year in May, surpassing forecasts and remaining above the Bank of Japan's 2.0% inflation target. Although the rate of increase is expected to decelerate in the middle of fiscal 2023, the target has consistently been exceeded for over a year. Flash Purchasing Managers' Index (PMI) data for June showed a decline in manufacturing output due to relatively muted demand conditions domestically and internationally. However, the services sector continued to experience strong overall growth as customer numbers and spending rebounded from the impact of the pandemic.

China

Chinese stocks experienced a decline following a holiday-shortened week, with investor confidence diminishing due to the lack of stimulus measures and concerns about the sluggish post-pandemic recovery. The Shanghai Stock Exchange Index fell 2.3%, while the CSI 300, comprising blue-chip stocks, dropped 2.51%. In Hong Kong, the Hang Seng Index recorded its biggest drop in three months, declining by 5.74%. Mainland China's financial markets were closed for the Dragon Boat Festival holiday, while the Hong Kong Exchange resumed trading on Friday.

Despite no major economic indicators being released, mounting evidence suggested that China's economic recovery was losing momentum, leading to concerns about the overall economic outlook. Weaker results in recent weeks prompted several key banks to revise down their growth forecasts for China in 2023. The country is grappling with slowing export demand, a prolonged housing market slump, and weak business and consumer confidence.

Chinese banks reduced their one- and five-year loan prime rates by 10 basis points, in line with expectations, following the People's Bank of China's (PBOC) cut in the medium-term lending facility rate the previous week. Some analysts had anticipated a larger reduction of 15 basis points in the five-year rate.

In an effort to boost sales and production in the electric vehicle (EV) market, Beijing introduced a four-year tax break package for consumers purchasing new EVs. This move aligns with the State Council's call for extended and optimized tax breaks on EV purchases, aiming to revive demand in the struggling sector.

Overall, investor sentiment in Chinese stocks was dampened by the absence of significant stimulus measures, concerns about the weakening economic recovery, and the need to address challenges in key sectors such as exports and the housing market.

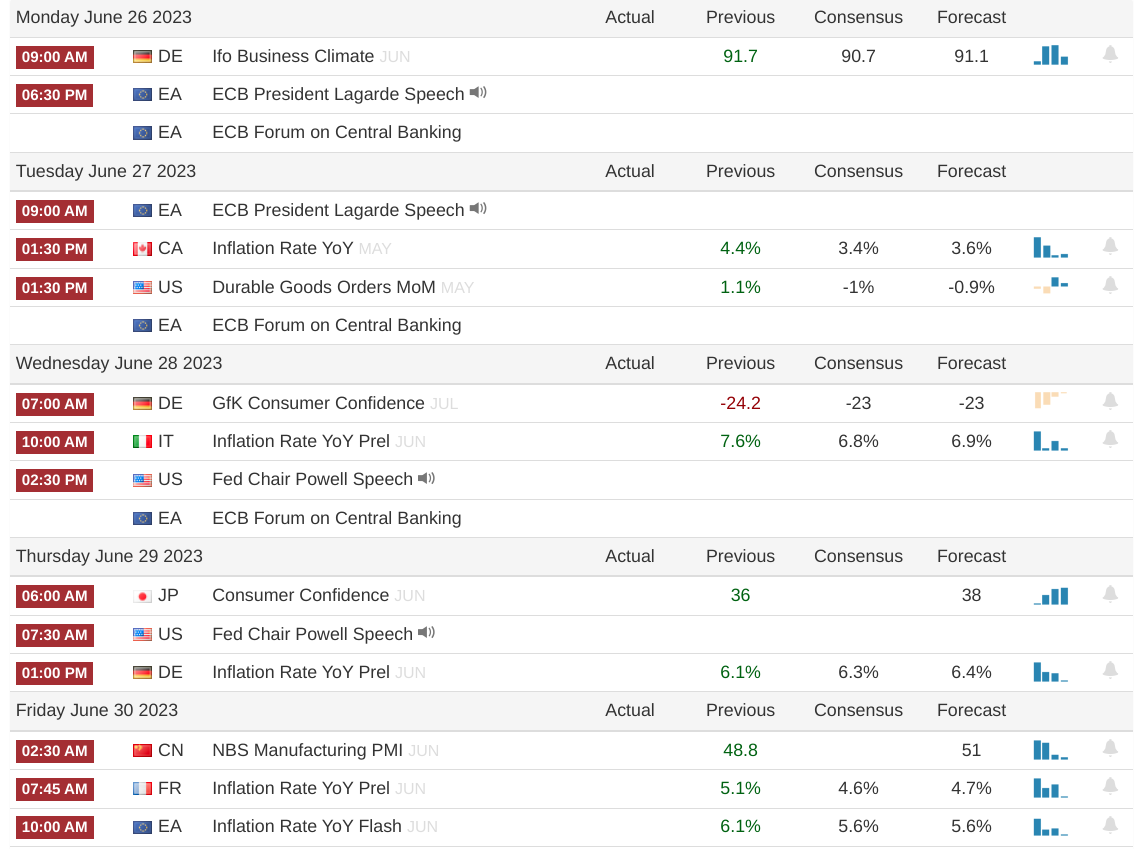

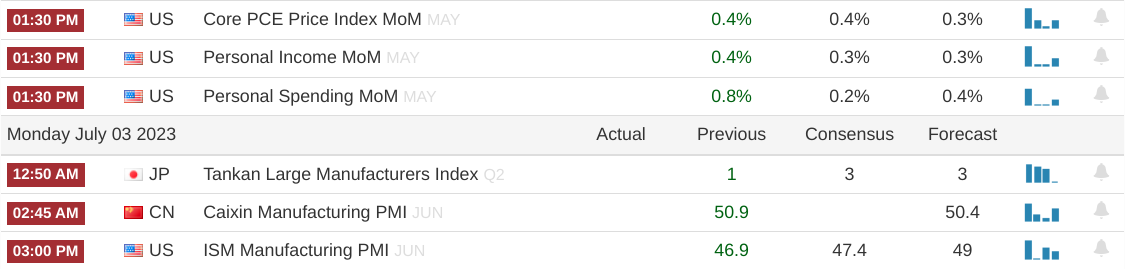

2. Week Ahead