Global Markets Recap - Week of June 26, 2023

1. What Moved the Markets?

Europe

The pan-European STOXX Europe 600 Index rose 1.94% on hopes of increased Chinese consumption and lower inflation suggesting near-peak interest rates. Major European stock indexes also saw gains: CAC 40 (+3.30%), FTSE MIB (+3.75%), DAX (+2.01%), and FTSE 100 (+0.93%).

European government bond yields remained high despite easing inflation. Eurozone inflation slowed for the third month, reaching 5.5% in June, while core inflation ticked up to 5.4%.

Reports from the ECB's Forum on Central Banking suggest another interest rate hike in July, although uncertainty remains. BoE Governor Bailey hinted that UK interest rates may stay higher for longer than market expectations. The Swedish central bank raised its key interest rate to 3.75% and forecasts at least one more increase this year.

US

The major benchmarks ended the quarter on a positive note, driven by positive growth and inflation surprises. The S&P 500 recorded its best weekly gain since March, with small-caps and value shares outperforming. The Nasdaq Composite continued to lead with a six-month gain of nearly 32%, its best start to the year since 1983. Apple reached a market capitalization above $3 trillion, surpassing the valuation of five sectors in the S&P 500.

Inflation data provided a boost as the PCE price index increased by 0.1% in May, bringing the year-over-year increase down to 3.8%. Core PCE, the Fed's preferred inflation gauge, fell back to 4.6% year-over-year, calming fears of accelerating price pressures. Other positive signals included rising private sector incomes, a significant drop in jobless claims, higher consumer sentiment, and better-than-expected durable goods orders and new home sales.

The Treasury market reacted negatively to the positive economic data, pushing the 10-year yield to its highest level since March. Municipal bonds initially faced challenges due to an unfavorable ruling involving Puerto Rico utility bonds but later outperformed Treasuries. Investment-grade corporate bonds saw low issuance but strong demand, while the high yield market benefited from risk-on sentiment.

Overall, a favorable macro backdrop and positive economic indicators contributed to the solid performance at the end of the quarter.

Japan

Japan's stock markets experienced gains, with the Nikkei 225 Index rising 1.2% and the broader TOPIX Index up 1.1% for the week. Japanese equities performed well in local currency terms, although the weakness of the yen moderated returns in US dollar terms.

Japanese monetary authorities expressed readiness to address excessive volatility in foreign exchange markets as the Japanese currency approached a seven-month low against the US dollar. Despite expectations of possible intervention by the Bank of Japan (BoJ), no concrete action was taken.

The yield on the 10-year Japanese government bond increased to 0.39% due to continued monetary policy divergence between the BoJ and other major central banks. BoJ Governor Kazuo Ueda and US Federal Reserve Chair Jerome Powell reiterated their current policy stances.

Ueda mentioned that while headline inflation in Japan is above 3%, underlying inflation remains below target, justifying the maintenance of an easy monetary policy. He stated that if the BoJ becomes confident that inflation will accelerate into 2024 after a period of moderation, it would be a reason to consider a shift in monetary policy.

The core consumer price index for the Tokyo area rose 3.2% year-on-year in June, surpassing the BoJ's 2% target for over a year. This adds pressure on the central bank to tighten its ultra-loose monetary policy.

China

Stocks ended the session with mixed results in China, as weak economic indicators overshadowed hopes of additional government measures to stimulate economic growth. The Shanghai Stock Exchange Index gained 0.13%, while the CSI 300 blue chip index fell 0.56%. In Hong Kong, the Hang Seng Index slightly increased by 0.14%.

China's manufacturing Purchasing Managers' Index (PMI) for June improved to 49.0, indicating a slight expansion compared to May's 48.8. However, the nonmanufacturing PMI decreased to 53.2, suggesting slower growth in the service and construction industries.

Industrial profits in China declined by 18.8% in the first five months of 2023, a smaller contraction compared to the previous months. Premier Li Qiang expressed confidence that China would achieve its annual growth target of around 5% and promised additional measures to boost domestic demand and support market development.

During the Dragon Boat Festival holiday, domestic travel showed signs of recovery, increasing by 89.1% compared to the previous year. However, travel levels remained 22.8% below pre-pandemic levels from 2019, according to the Ministry of Transport.

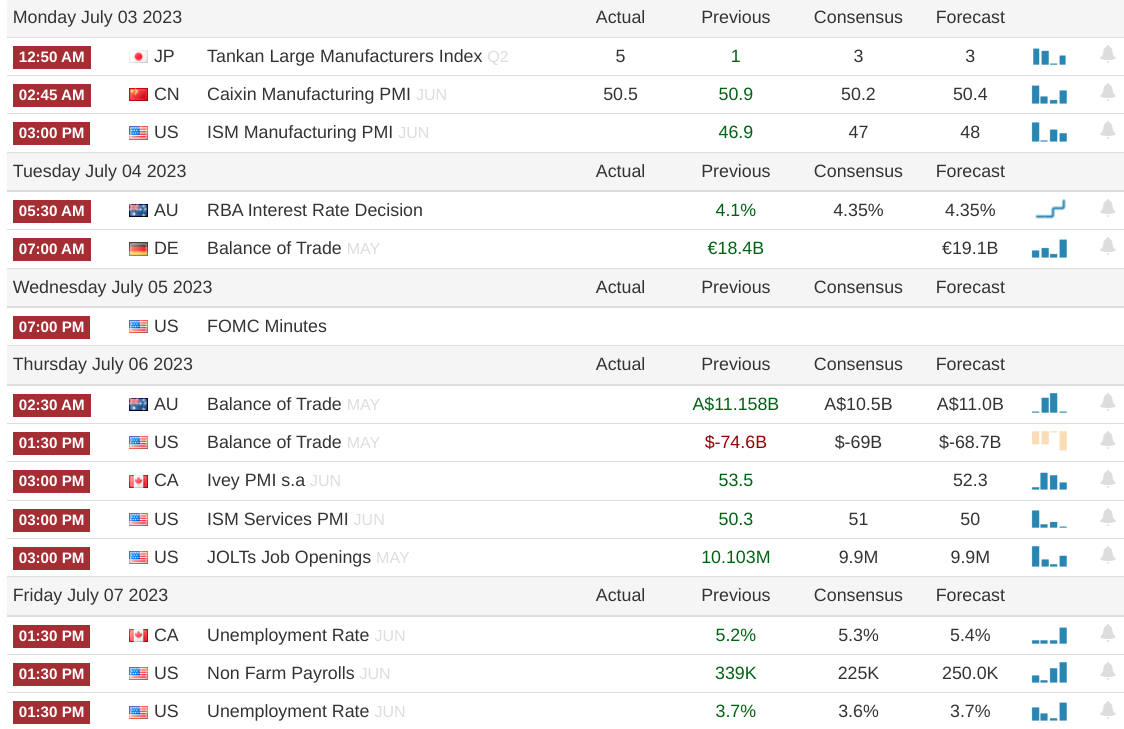

2. Week Ahead