Week of March 13, 2023 - Global Markets Recap

1. What Moved the Markets?

What a historic week! Credit Suisse is now officially acquired by UBS.

Europe

The financial strains in Europe caused a significant drop in shares, with the pan-European STOXX Europe 600 Index falling 3.84% in local currency terms. Major stock indexes such as France’s CAC 40 Index (-4.09%), Germany’s DAX Index (-4.28%), Italy’s FTSE MIB Index (-6.55%), and the UK’s FTSE 100 Index (-5.33%, biggest drop since June 2020) also experienced declines ranging from 4.09% to 6.55%. Within the STOXX Europe 600 Index, the banking sector suffered the most, as Credit Suisse's challenges raised concerns about counterparty risk in the financial system.

The European Central Bank (ECB) announced a half-point rate hike to 3.0% to control inflation, with projections estimating average inflation at 5.3% in 2023 and 2.1% in 2025. The ECB also reported a revised growth forecast for 2021 at 1.0%, indicating lower energy prices and the economy's resilience amid challenges. The UK's jobless rate remained steady at 3.7%, near a record low, while total pay growth decreased from 6.0% to 5.7% in the period.

The UK finance minister, Jeremy Hunt, revealed a larger-than-expected spending of around GBP 20 billion in the budget, which included measures such as a 100% tax break on business investment, an energy price cap extension to support households, and free childcare expansion, among others. However, there were no new tax cuts, and the corporate tax will still increase to 25%.

US

Last week, the stock market experienced mixed results due to stresses in the banking sector, concerns over a slowdown in the economy, and hopes that the Federal Reserve would pause or moderate its rate-hiking cycle. YTD, Dow (-3.88%), S&P 500 (+2.01%), Nasdaq (+11.12%), S&P MidCap 400 (-2.30%), Russell 2000 (-2.01%). Mega-cap tech shares and large-cap growth stocks outperformed their value counterparts. The failure of Silicon Valley Bank and the closure of New York's Signature Bank had caused worries, but the Fed made additional funding available to banks to safeguard deposits and announced an internal review of its supervision and regulation of SVB. Analysts predict that regulators may propose increased capital requirements for regional banks, but significant new banking legislation is unlikely. Investors expect rates to end the year lower than their current range of 4.50% to 4.75%. The struggles of First Republic Bank also weighed on sentiment, but major banks deposited USD 30 billion to calm fears about its balance sheet. Lower growth expectations and higher risk aversion led to a sharp drop in longer-term Treasury yields, but credit spreads widened to a four-month high, and no new deals reached the market due to volatility.

Japan

The global banking sector's turmoil had a limited direct impact on Japan's financial system, but it did cause a dip in investor sentiment, resulting in a sharp decline in Japanese equities. The Nikkei was down by 2.88% for the week, while the TOPIX Index fell by 3.55%. However, losses were partially mitigated by speculation that major central banks could take a less aggressive approach to monetary policy tightening in response to the week's events and concerns about broader weakness in the global economy.

Investors sought out assets perceived as safer due to growing risk aversion, causing the yield on the 10-year Japanese government bond to fall to 0.30% from 0.42% at the end of the prior week. The yen also strengthened to about JPY 133 against the US dollar from around JPY 135 the previous week due to the flight to safety.

According to Prime Minister Fumio Kishida, the Japanese banking system is stable as a whole, and the government will work closely with the Bank of Japan (BoJ) to respond appropriately to recent market volatility caused by concerns about US and European banks. While many observers believe that Japanese banks have limited funding and liquidity risks, concerns have grown about the impact of global market turmoil on BoJ monetary policy. The central bank's upcoming April meeting, chaired by incoming Governor Kazuo Ueda, is likely to be closely watched for any pivot from the current ultra-loose stance.

In other news, the annual "shunto" spring wage negotiations between businesses, major industrial unions, and government leaders in Japan have concluded. Many large Japanese companies, including leading equipment manufacturers and automakers, have agreed to the biggest pay raises in decades, with a hike of over 3% according to the Japanese Trade Union Confederation (RENGO). Prime Minister Kishida has called on businesses to raise wages to support the government's "new capitalism" agenda, which aims to promote a fairer distribution of income and stronger growth.

China

Chinese stock markets experienced a mixed week as global banking concerns offset positive sentiment about economic recovery and additional monetary support from Beijing. The Shanghai Stock Exchange Index increased by 0.63%, while the blue-chip CSI 300 Index fell by 0.21% in local currency terms. Meanwhile, the benchmark Hang Seng Index in Hong Kong rose by 1%.

The People’s Bank of China (PBOC) announced that it will reduce the reserve requirement ratio (RRR) for most banks by 25 basis points for the first time in 2023. This move aims to ensure liquidity and support economic growth. The PBOC had previously cut the RRR by the same magnitude in December. Additionally, the PBOC injected RMB 481 billion into its financial system through its one-year medium-term lending facility, which was higher than the RMB 200 billion in maturing loans. The central bank kept the medium-term lending rate unchanged as expected.

These actions come after PBOC Governor Yi Gang's surprise reappointment for another term, which had a calming effect on the markets following the recent revamp of central government institutions under China's cabinet, the State Council. Some analysts believe that Yi's retention is a sign that China prioritizes financial stability as it focuses on supporting the economy amid rising growth challenges.

In other economic news, new home prices in 70 of China's largest cities rose by 0.3% in February, marking the fastest increase since July 2021, according to the National Bureau of Statistics. China's real estate market had been in decline due to cash-strapped property developers struggling with slowing sales and high debt levels. However, the sector has shown signs of recovery in recent months, thanks to Beijing's dismantlement of its zero-COVID policy in December.

New bank loans in February totaled RMB 1.81 trillion, higher than expected and compared to January's record of RMB 4.9 trillion. While credit expansion typically slows in February, China's accommodative policy and post-COVID recovery led to a pickup in economic activity last month.

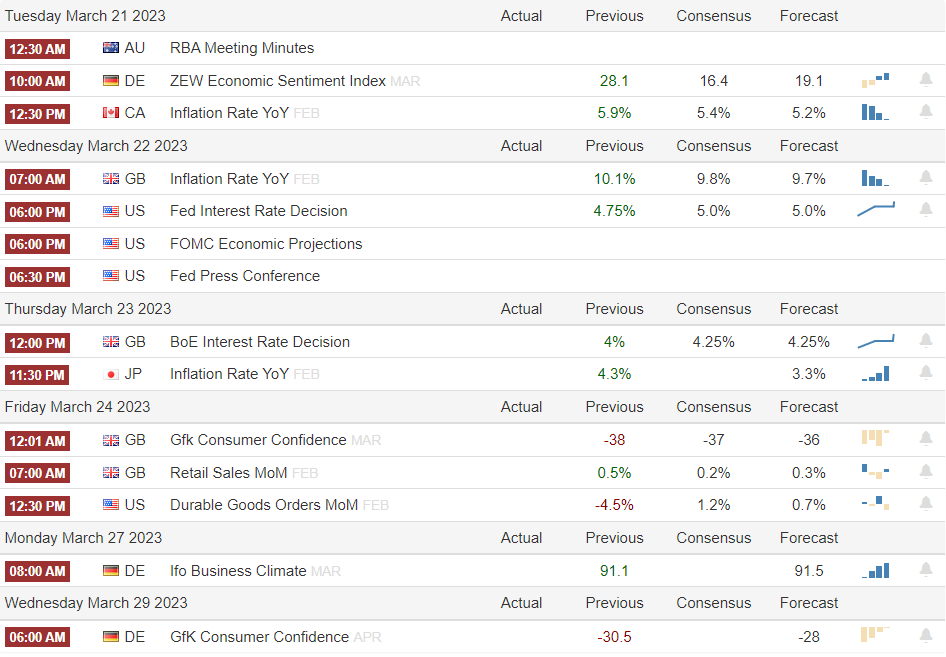

2. Week Ahead

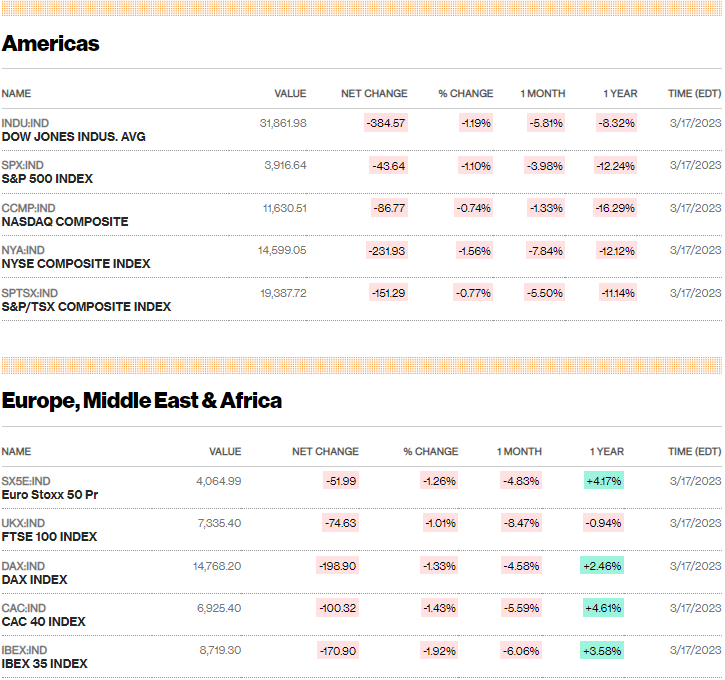

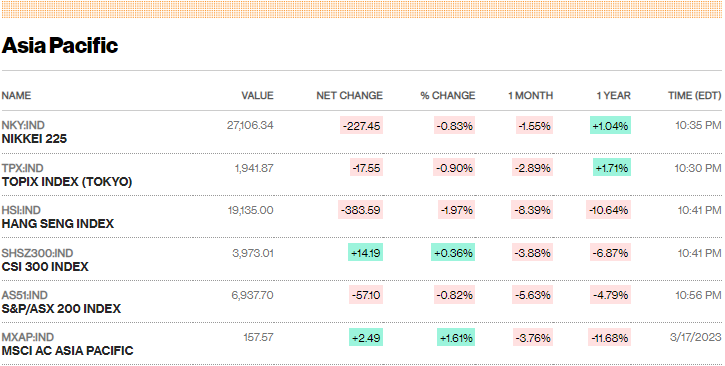

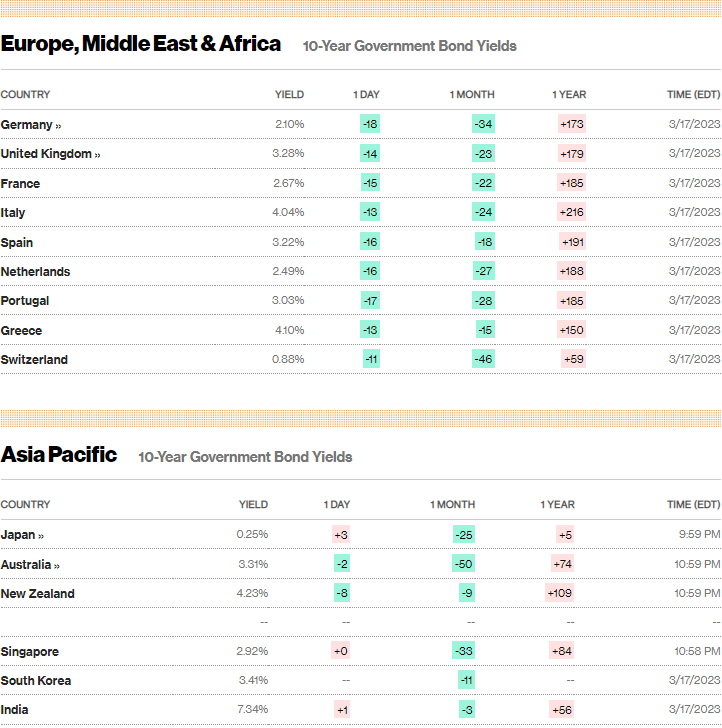

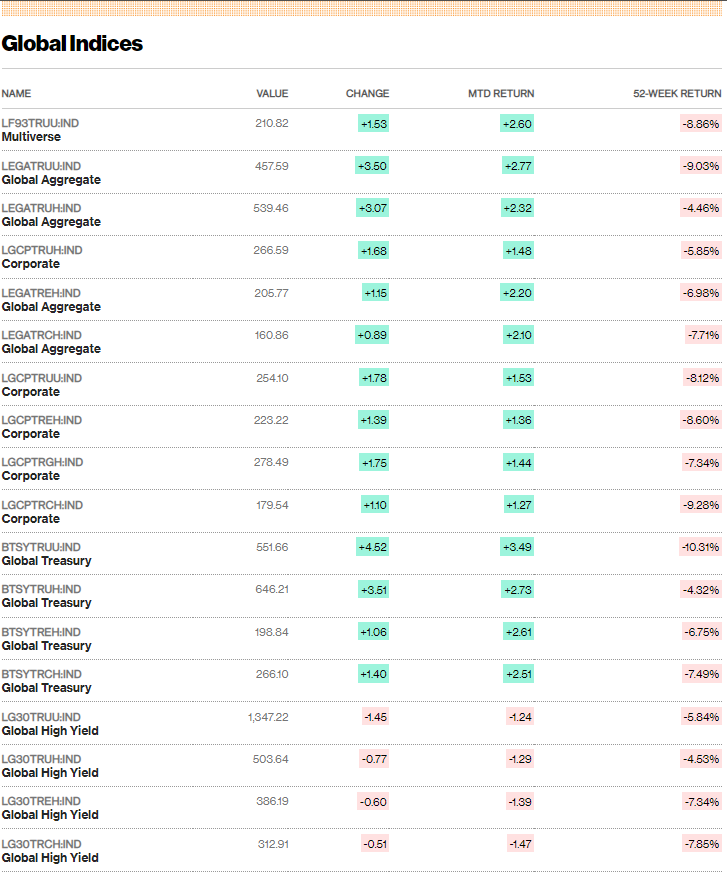

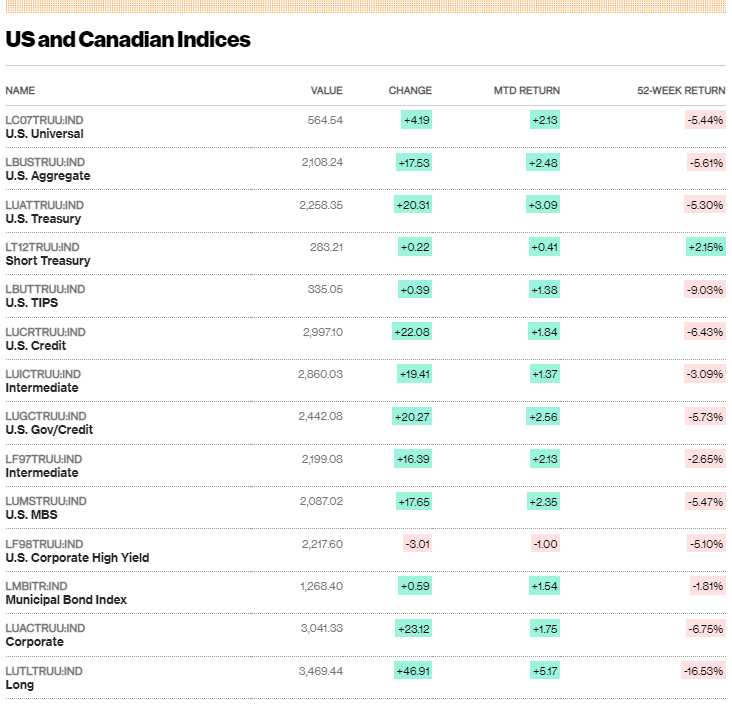

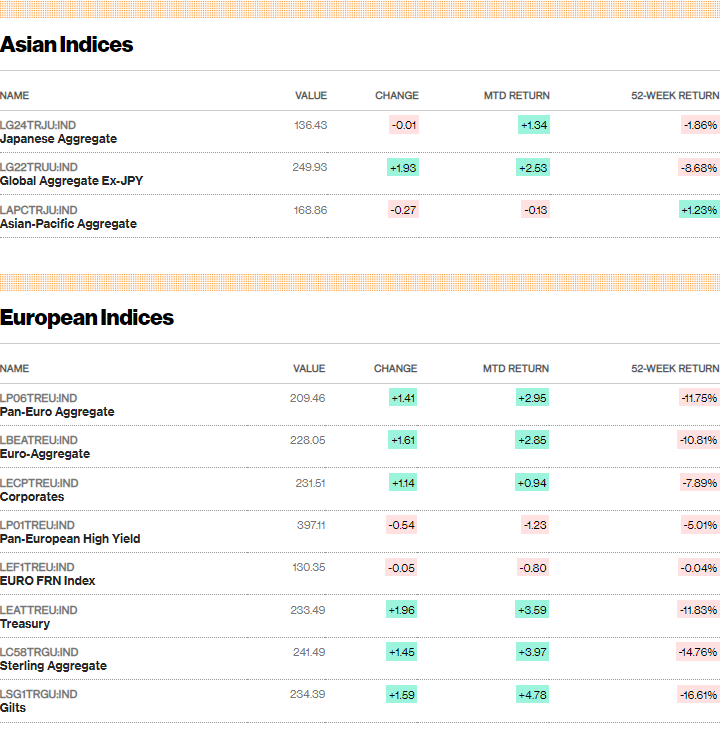

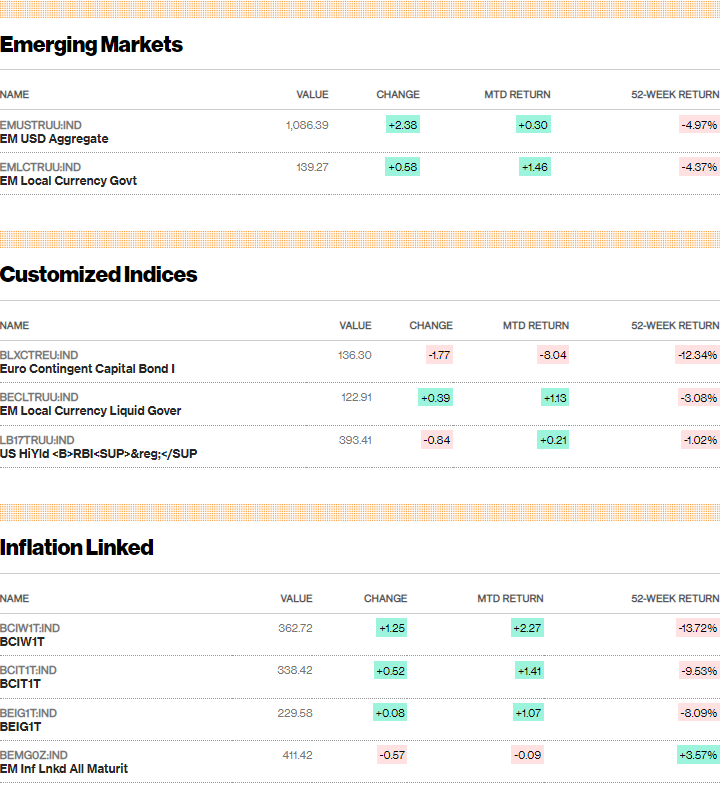

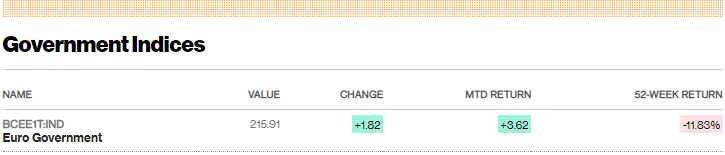

3. Bloomberg Market Data as of March 17 2023

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)