Week of March 20, 2023 - Global Markets Recap

1. What Moved the Markets?

Europe

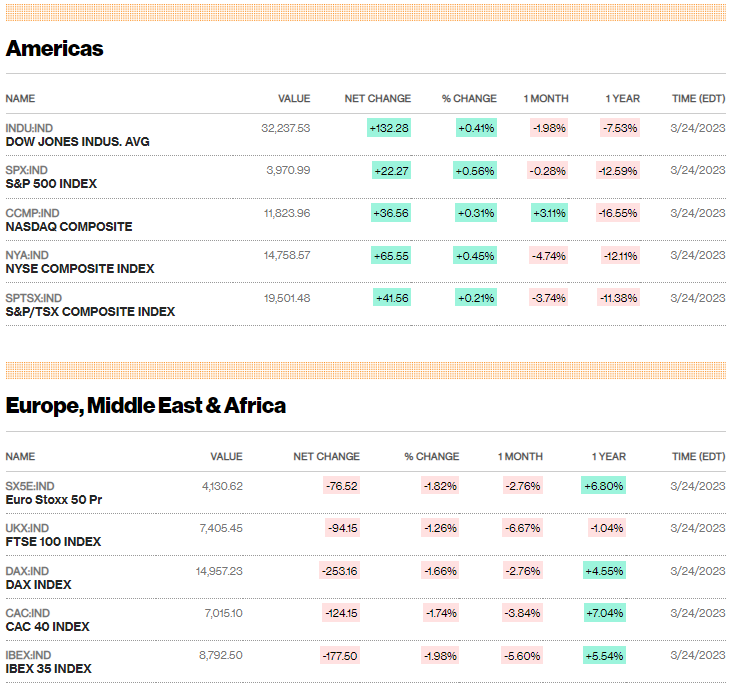

Despite weakness in bank stocks, shares in Europe gained ground with major stock indexes advancing. In local currency terms, the pan-European STOXX Europe 600 Index ended 0.87% higher, while Italy's FTSE MIB climbed 1.56%, France's CAC 40 Index gained 1.30%, Germany's DAX advanced 1.28%, and the UK's FTSE 100 Index added 0.96%.

However, bank stocks in the STOXX Europe 600 Index resumed their sharp decline at the end of the week on renewed worries over the health of the financials sector. This came after earlier gains on the news that UBS Group agreed to buy Credit Suisse in a deal brokered by the Swiss authorities. Since then, the market focus appeared to have shifted to concerns about banks with exposure to commercial real estate.

The Bank of England (BoE) surprised the market by raising interest rates to 4.25% from 4.00%, the 11th consecutive increase. The Financial Policy Committee told policymakers before the vote that the "UK banking system maintains robust capital and strong liquidity positions" and "that the UK banking system remains resilient." Financial markets expect rates to increase again, as inflation continues to rise. On a year-over-year basis, consumer prices rose to 10.4% in February—well above the consensus expectation.

The latest macroeconomic data pointed to a resilient UK economy, with a purchasing managers' survey indicating a possible return to growth in the first quarter. S&P Global's Composite Purchasing Managers' Index (PMI), which measures activity in manufacturing and services, registered an expansion in business activity for a second consecutive month in March. Retail sales volumes rose 1.2% in February—the largest monthly gain since October.

In the Eurozone, business activity expanded faster than expected in March, driven by strong growth in the services sector. A preliminary reading of S&P Global's Eurozone Composite PMI rose to a 10-month high of 54.1 in March from 52 in the previous month. However, manufacturing activity fell across most countries, especially Germany, due mainly to a rise in supplier delivery times.

US

The returns of major stock market indexes varied greatly in the week, with small-cap stocks joining the Dow in negative territory for the year. The banking industry and recession concerns weighed on value stocks and small-caps, while large-cap growth stocks benefited from falling interest rates. The Nasdaq Composite outperformed the small-cap Russell 2000 Index by 8.28 percentage points. Financials continued to underperform for a third consecutive week, and the small real estate sector suffered due to worries about the effect of stresses in the regional banking system on the commercial real estate market.

Although the S&P 500 Index rose 0.81% for the week, the average stock remained significantly weaker than the index's return, with the S&P Equal Weight Index still down 1.89% for the year. The S&P MidCap 400 and Russell 2000 indexes also moved into negative territory for the year. Despite this, trading activity was calmer than the previous week, with the CBOE Volatility Index (VIX) hitting its lowest level since March 9 before climbing back somewhat on Friday.

The Federal Reserve raised official short-term rates by 25 basis points during the week, as expected, and the dot plot indicating individual policymakers' rate expectations showed a growing disparity in outlooks, with officials expected to stop raising rates after one more hike in May. Fed Chair Jerome Powell's post-meeting press conference suggested that the Fed's change in tone was driven by forecast uncertainty rather than a strong conviction that a 5.0% to 5.25% fed funds target range (assuming a 25 bps rate increase in May) would be sufficiently restrictive. Powell warned that policymakers still "anticipate some additional policy firming may be appropriate," but investors were not convinced, with futures markets ending the week pricing in a 98.2% chance that rates would end the year lower and a 94.8% chance that cuts would start this summer.

Despite banking turmoil, economic data suggested that the economy still had significant steam. Weekly jobless claims remained near five-decade lows, and S&P Global's Composite Index of both current services and manufacturing activity jumped to its fastest pace of private sector growth since last May. Data regarding core capital goods orders also surprised to the upside, with such orders increasing in February. In the corporate bond market, new deals were dominated by utility providers and saw healthy demand, while the high yield market saw no new issuance for a third consecutive week.

Japan

Japan's stock markets had mixed results for the week, as the Nikkei 225 Index gained 0.19% while the broader TOPIX declined 0.21%. However, investor concerns over the global banking sector eased slightly after six major central banks, including the Bank of Japan (BoJ), announced coordinated action on March 19 to improve liquidity provision and ease strains in global funding markets. The yen strengthened after the U.S. Federal Reserve's interest rate hike, finishing the week at around JPY 130.6 against the U.S. dollar.

Consumer inflation in Japan slowed as the rate of core consumer price index rose 3.1% year on year in February, down from January's 4.2%, which was a four-decade high. The government provided electricity subsidies to cushion the impact of price pressures, leading to the notable drop in energy contribution. A government panel endorsed plans to add more than JPY 2 trillion to existing inflation relief measures, which will help with responding to the rise in energy prices and support low-income households.

Japan's services and manufacturing sectors experienced a divergence in their fortunes, with service providers seeing solid improvement as government support and an increase in Chinese tourism boosted demand, while the manufacturing sector contracted, with output and new orders falling.

In the Summary of Opinions from its March meeting, the BoJ acknowledged calls to revise its accommodative monetary policy due to recent price rises, but noted that the risk from hasty policy change is more significant than the risk from delaying a change. The BoJ will carefully consider and discuss whether to revise its policy as revisions can affect financial markets and a wide range of economic entities.

China

Chinese equities climbed on expectations that the central bank will continue its accommodative monetary policy amidst the global banking turmoil. In local currency terms, the Shanghai Stock Exchange Index advanced by 0.46% and the blue-chip CSI 300 rose by 1.72%. The benchmark Hang Seng Index in Hong Kong gained 2.03%.

The People’s Bank of China (PBOC) kept its benchmark one-year and five-year loan prime rates (LPR) unchanged at 3.65% and 4.3%, respectively, for the seventh consecutive month. The LPRs are based on the interest rates that 18 banks offer their best customers and are published monthly by the PBOC. They are quoted as a spread over the rate on the central bank's one-year policy loans, known as the medium-term lending facility (MLF). The decision was largely anticipated after the PBOC left its MLF rate unchanged the previous week and unexpectedly cut the reserve requirement ratio for most banks by 25 basis points, a move widely interpreted as an easing measure to support the economy.

Despite China's economic recovery, fiscal revenues decreased by 1.2% in the first two months of 2023 compared to the same period last year, while expenditures rose by 7%. State land sales revenue, a significant source of direct funds for local governments, dropped by 29% due to the persistent weakness in the housing market, despite the government's efforts to support the property sector.

While China's economic indicators have recently improved, with consumption and infrastructure investment rebounding from pandemic lockdowns, many analysts predict that policymakers will continue their accommodative stance in response to the banking industry turmoil, which is straining the global growth outlook.

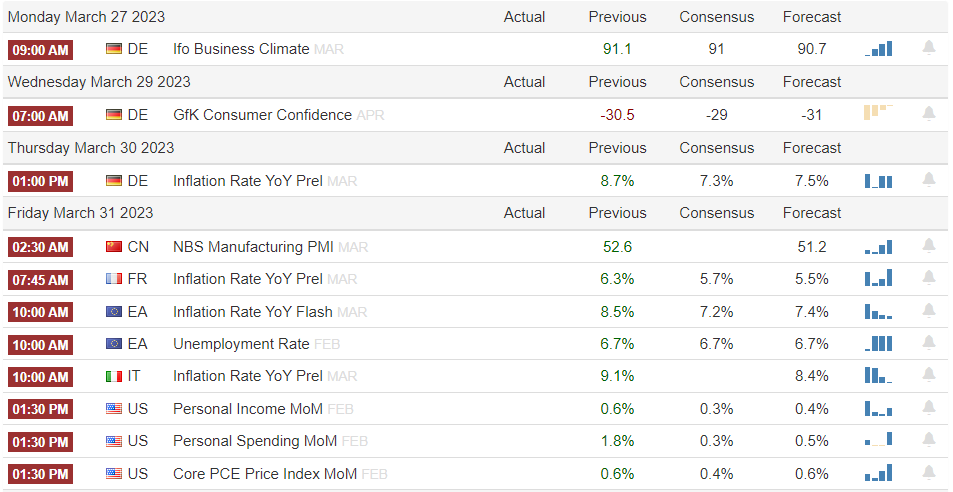

2. Week Ahead

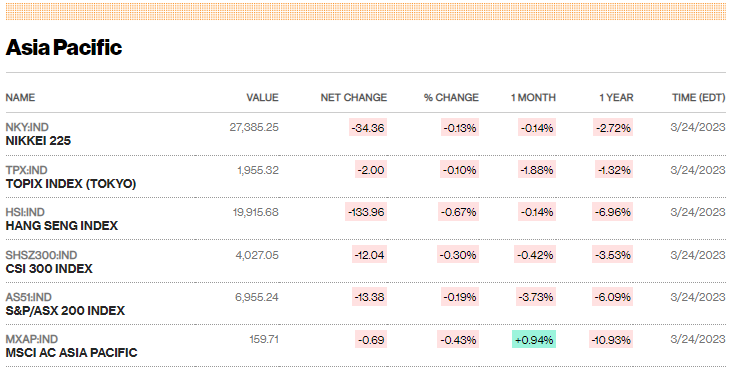

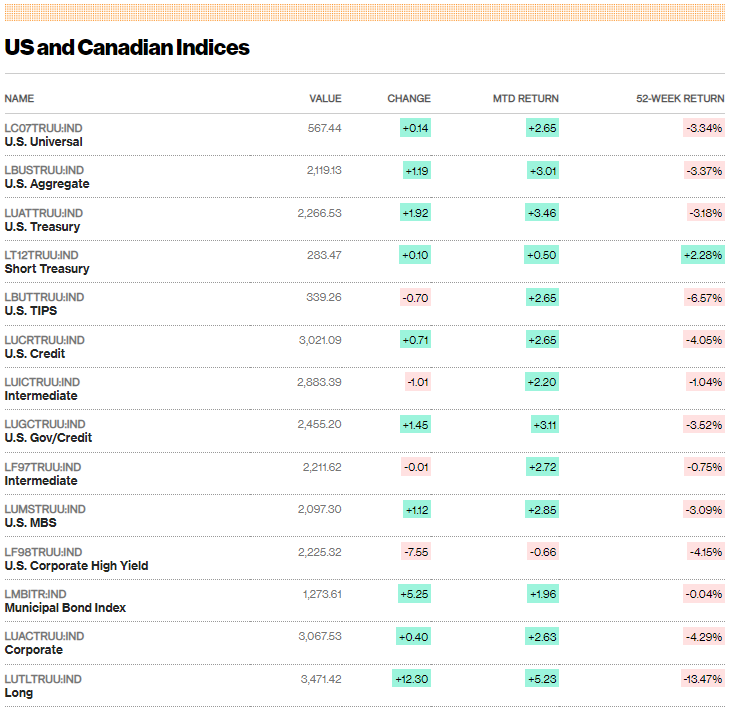

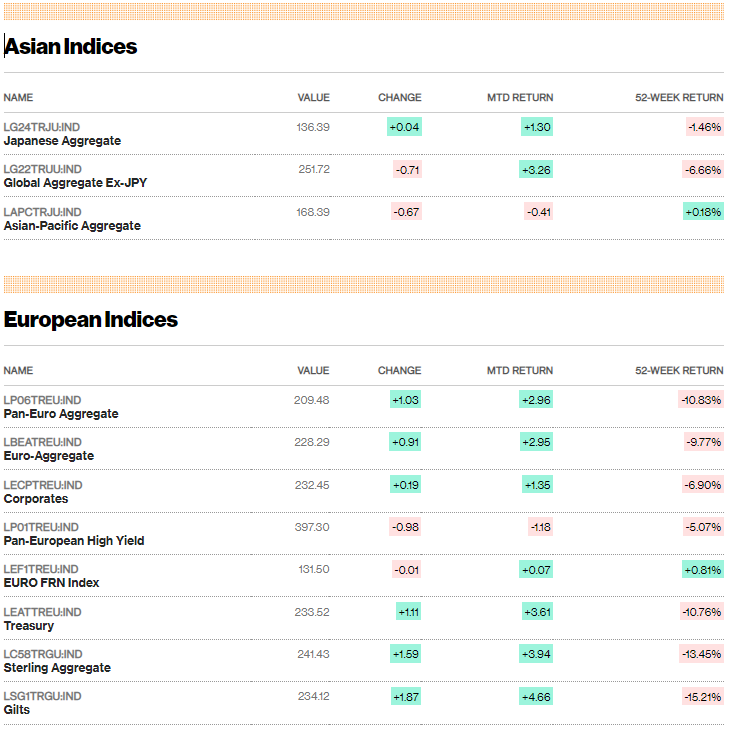

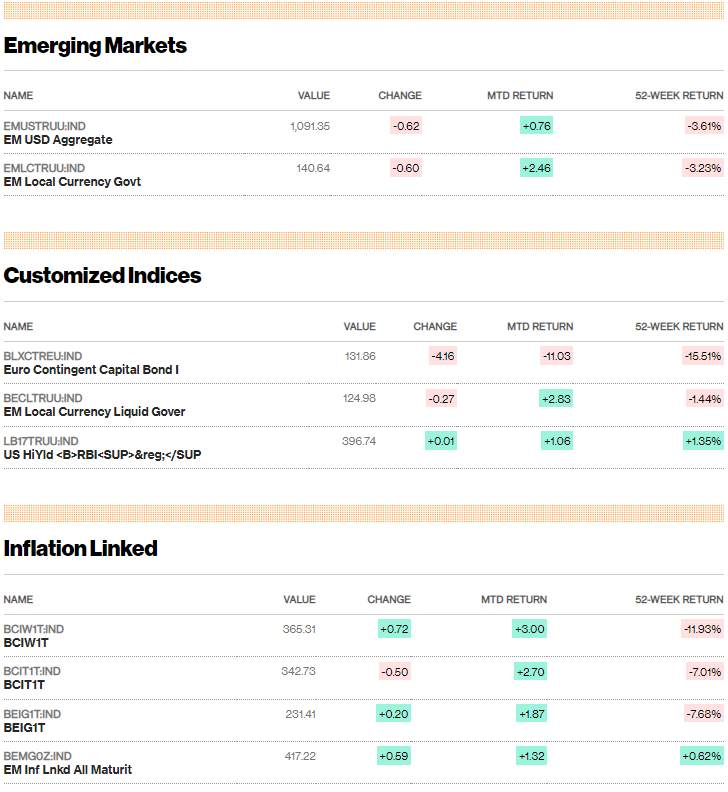

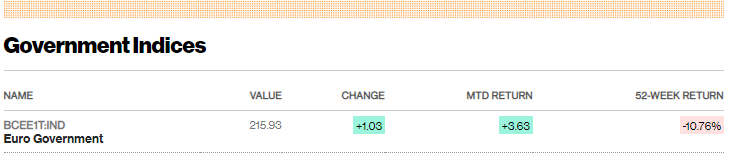

3. Bloomberg Market Data as of March 24, 2023

![Finance | Leadership] How I Built a Global Career in Finance: A prelude to the upcoming series: Breaking Into Finance](https://images.unsplash.com/photo-1676471049029-f93852da351d?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDl8fG1vdW50YWluJTIwZXZlcmVzdHxlbnwwfHx8fDE3NjQwNTgyMjB8MA&ixlib=rb-4.1.0&q=80&w=720)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)

![Markets | Leadership] FII - the Board of Changemakers Summary: Geo-Economics 2025: AI Power, Tokenized Finance, and the New Capital Map](/content/images/size/w720/2025/10/Screenshot-2025-10-31-130048.png)