Week of March 27, 2023 - Global Markets Recap

Hi All,

We officially closed Q1 2023 this week! What a quarter it has been! And now, hope everyone is getting into the Easter holiday spirit. Enjoy your holidays with beloved friends and family around the world!

1. What Moved the Markets?

Europe

European shares saw a rally as concerns about financial instability abated. The pan-European STOXX Europe 600 Index ended 4.03% higher, while major indexes in France (+4.38%), Germany (+4.49%), Italy (+4.72%), Switzerland (+4.41%), and the UK (+3.06%) posted strong gains. In the bond market, yields on benchmark 10-year German government bonds ticked up as investors digested strong core inflation data and hawkish comments from European Central Bank policymakers. French and Swiss bond yields also rose as concerns about the global banking sector eased. In the UK, yields on 10-year government debt climbed above 3.5% as expectations of another interest rate hike in May increased.

Meanwhile, protests against pension reforms in France continued, with around 740,000 people participating in nationwide demonstrations on March 28. Unions have called for an 11th day of national strikes on April 6, and Prime Minister Elisabeth Borne is set to hold talks with unions in the coming days.

Revised official data also showed that the UK avoided a recession in 2022, helped by government subsidies for energy bills. While gross domestic product in the third and fourth quarters shrank slightly, it was less than initially estimated. However, the housing market remained weak, with house prices falling at the fastest annual rate since the financial crisis and a big drop in net mortgage lending in February. Bank of England Governor Andrew Bailey stated that recent problems in the banking industry would not shift the central bank's focus from inflation and that UK lenders were resilient enough to support the economy.

US

In a relatively quiet week for economic data releases and financial news, the major equity indexes posted solid gains (Dow +3.22%, S&P +3.48%, NASDAQ +3.37%). Small-caps outperformed large-caps, and value stocks advanced modestly more than growth stocks. Bank stocks, which have declined sharply since the collapse of Silicon Valley Bank and Signature Bank earlier in March, advanced, with the widely followed KBW Bank Index easily outpacing the broad market’s gains. The market received some positive news on inflation, with the U.S. core personal consumption expenditure price index for February coming in slightly below expectations but still well above the Federal Reserve’s long-term inflation target. Treasury yields increased but took a breather from the worst of the elevated volatility that had dominated the market for U.S. government debt since SVB’s sudden collapse triggered worries that banking system turmoil could lead to recession. Tax-exempt municipal bonds performed better than Treasuries from a total return perspective, while bonds issued by some real estate investment trusts remained under significant pressure.

Japan

Japanese stock markets rose over the week, with the Nikkei 225 Index and the broader TOPIX Index up by 2.40% and 2.46%, respectively. Investors were encouraged by the easing concerns about the global banking sector and the possibility of the US Federal Reserve continuing to moderate its monetary tightening. In the domestic market, core consumer price inflation in the Tokyo area slowed for the second straight month in March, but still came in above expectations at 3.2% year-on-year, which exceeded the Bank of Japan's 2% inflation target. This fueled speculation that the central bank might tweak its ultra-loose monetary policy under incoming Governor Kazuo Ueda, who will take charge on April 9.

In other news, the Japanese government announced plans to restrict exports of 23 types of semiconductor manufacturing equipment, which will come into effect in July. Industry Minister Yasutoshi Nishimura said that Japan did not have any specific country in mind with these measures. Additionally, Prime Minister Fumio Kishida promised progress in the government's New Capitalism growth plan, which aims to narrow wage differentials between domestic firms and their overseas rivals.

China

Chinese stocks saw gains as supportive comments from Beijing and strong economic data boosted confidence in the country's growth outlook. The Shanghai Stock Exchange Index rose 0.22%, while the blue chip CSI 300 added 0.59% in local currency terms. The Hong Kong benchmark Hang Seng Index gained 2.43%. Premier Li Qiang reinforced China's commitment to open its economy and deliver reforms that can stimulate consumption and international business, while IMF Managing Director Kristalina Georgieva forecast that China's rebound would account for around one-third of global growth this year. Chinese e-commerce giant Alibaba Group announced a plan to break itself up into six units that can independently raise capital or seek initial public offerings. However, post-recovery data remained mixed, with official manufacturing Purchasing Managers' Index (PMI) rising to 51.9 in March, while industrial profits fell 22.9% in the first two months of 2023 from a year earlier, despite industrial output rebounding in the same period.

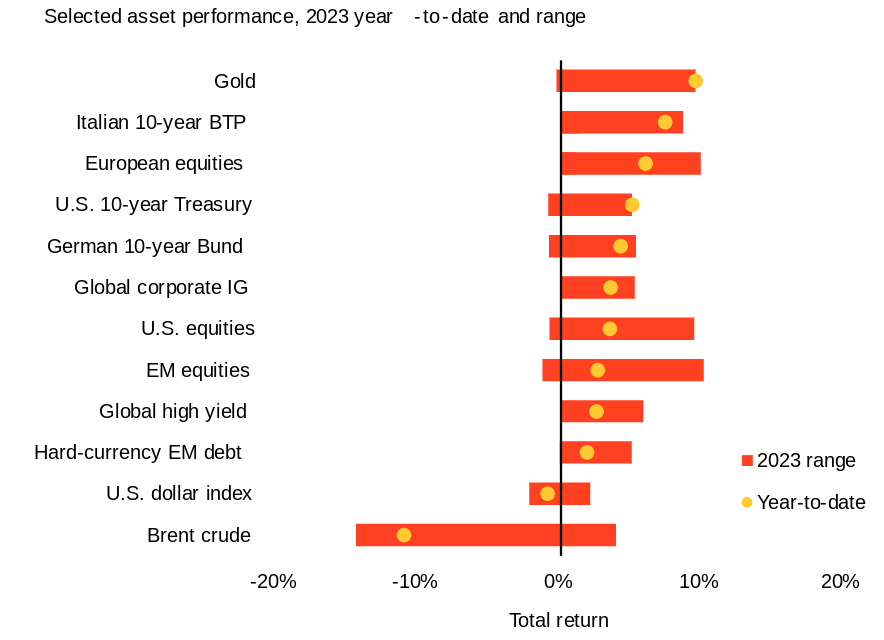

Asset classes YTD performances - Q1, 2023

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream as of March 23, 2023. Notes: The two ends of the bars show the lowest and highest returns at any point in the last 12-months, and the dots represent current year-to-date returns. Emerging market (EM), high yield and global corporate investment grade (IG) returns are denominated in U.S. dollars, and the rest in local currencies. Indexes or prices used are: spot Brent crude, ICE U.S. Dollar Index (DXY), spot gold, MSCI Emerging Markets Index, MSCI Europe Index, Refinitiv Datastream 10-year benchmark government bond index (U.S., Germany and Italy), Bank of America Merrill Lynch Global High Yield Index, J.P. Morgan EMBI Index, Bank of America Merrill Lynch Global Broad Corporate Index and MSCI USA Index.

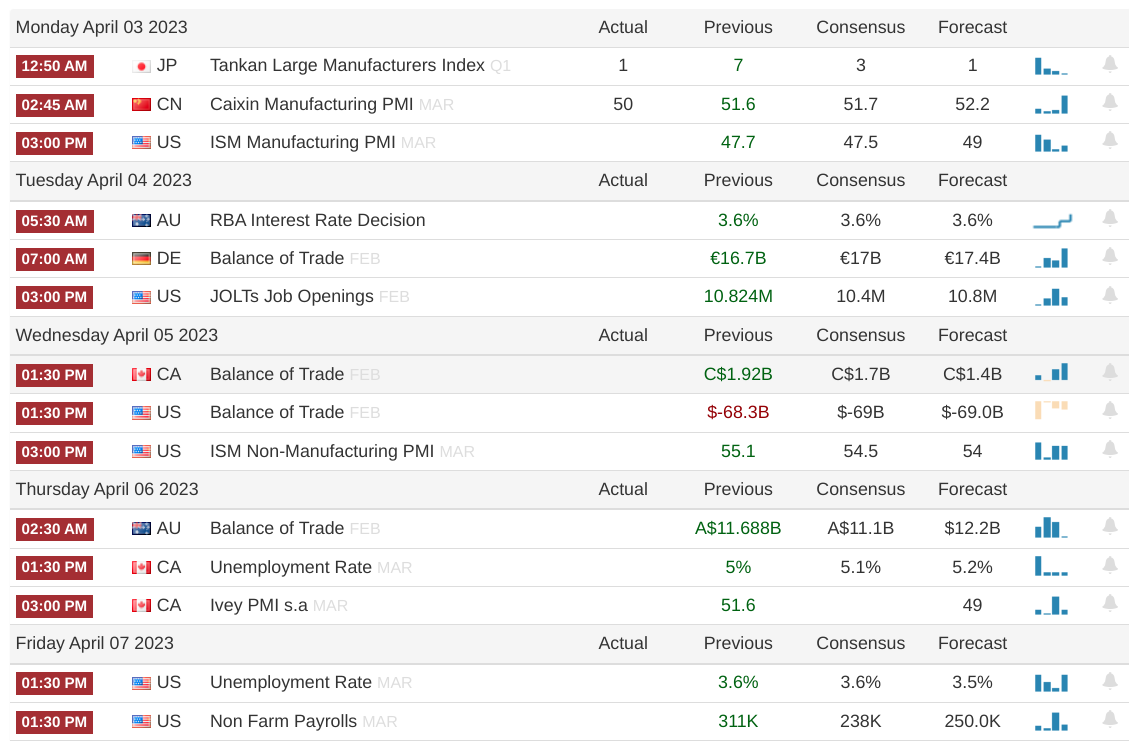

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)