Global Markets Recap - Week of March 6, 2023

1. What Moved the Markets?

Europe

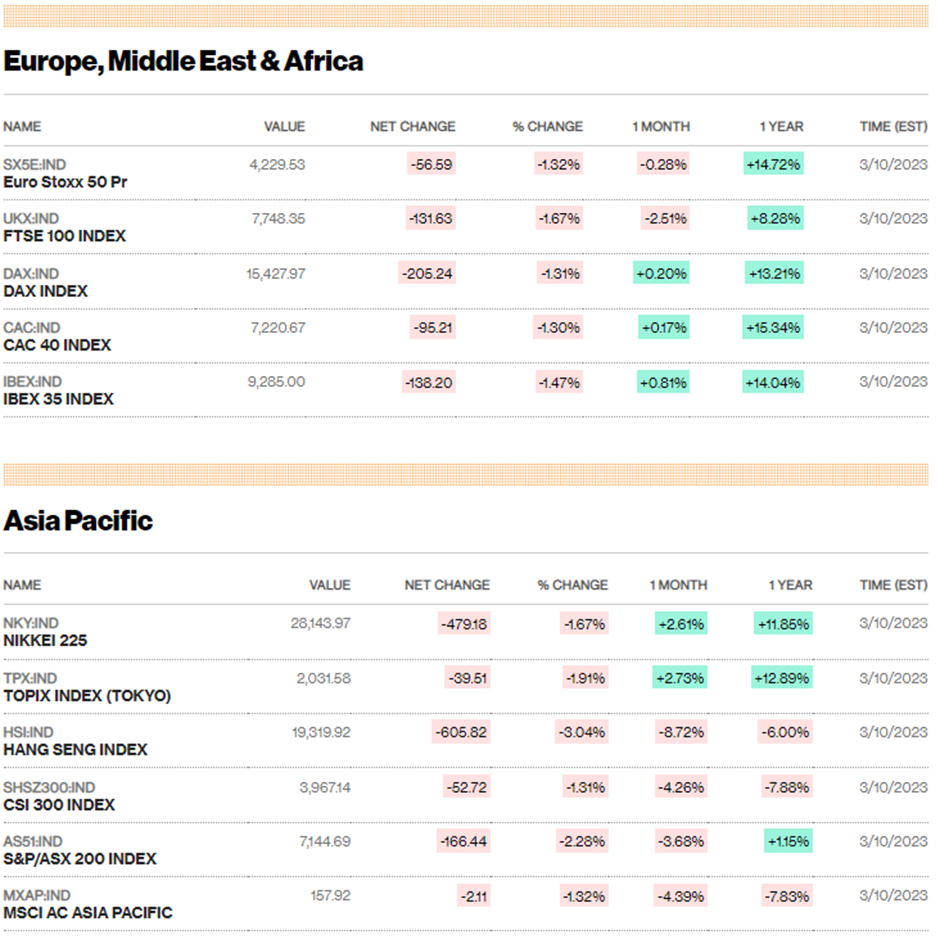

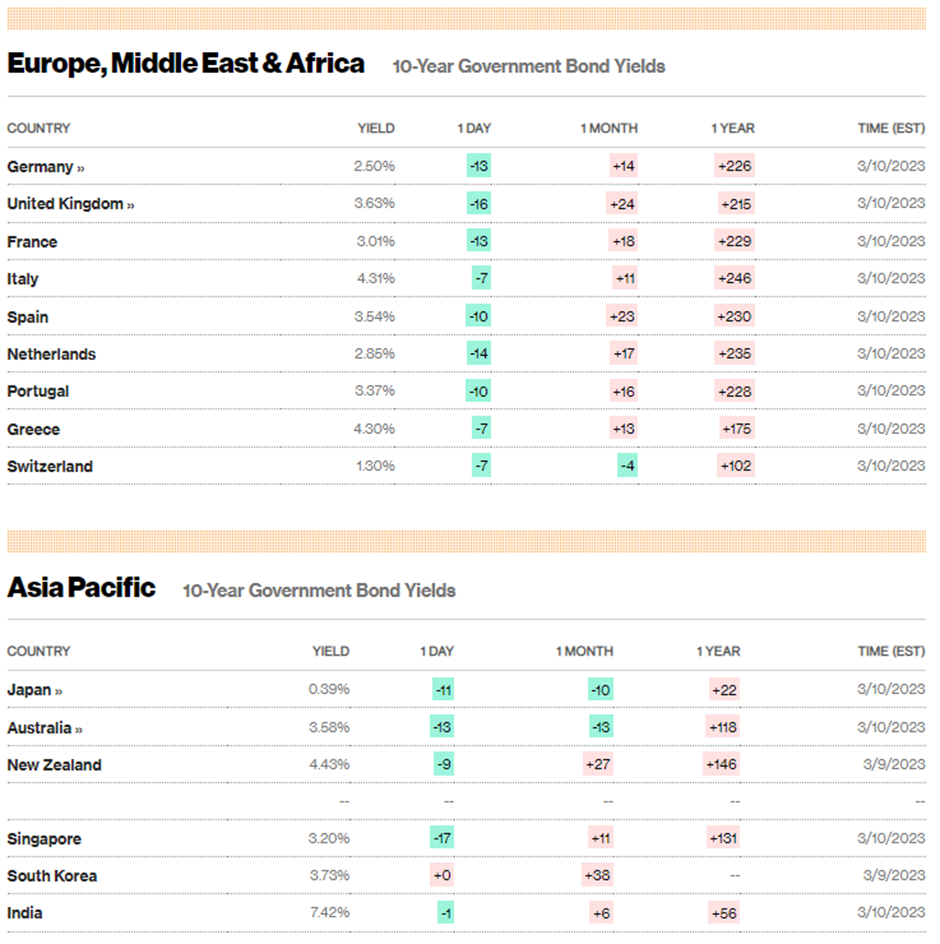

Shares in Europe experienced a decline in response to global market worries about stress in the banking system and potential prolonged elevated interest rates. The pan-European STOXX Europe 600 Index ended 2.26% lower in local currency terms, with major stock indexes such as Germany's DAX Index (-0.97%), France's CAC 40 Index (-1.73%), Italy's FTSE MIB Index (-1.95%.), and the UK's FTSE 100 Index (-2.50%) also falling. Bank of Italy Governor Ignazio Visco criticized ECB colleagues for making statements about future increases in borrowing costs, which appeared to contradict a prior agreement not to give such guidance. This disagreement may hint at rising tensions among policymakers in advance of next week's policy decision. Eurozone economic growth in Q4 2022 was revised down to 0% from an initial estimate of 0.1%, and consumer demand weakened in January, with retail sales growing much less than expected and dropping 2.3% YoY. German industrial production rebounded 3.5% sequentially in January, and manufacturing orders also rose thanks to increased demand from non-European countries. However, domestic and eurozone orders fell sharply, and retail sales continued to shrink. On a positive note, the UK economy rebounded more than expected in January, driven by growth in the services sector, with gross domestic product rising 0.3% sequentially after contracting in December.

US

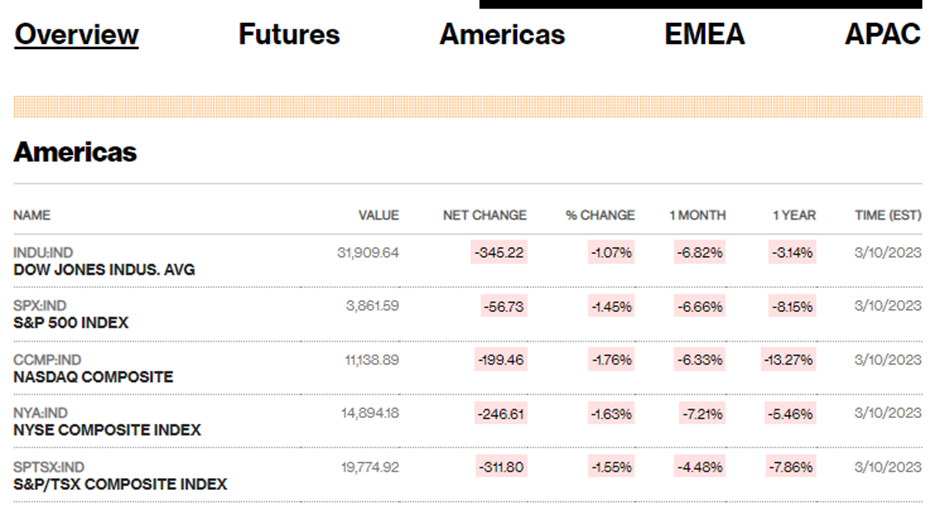

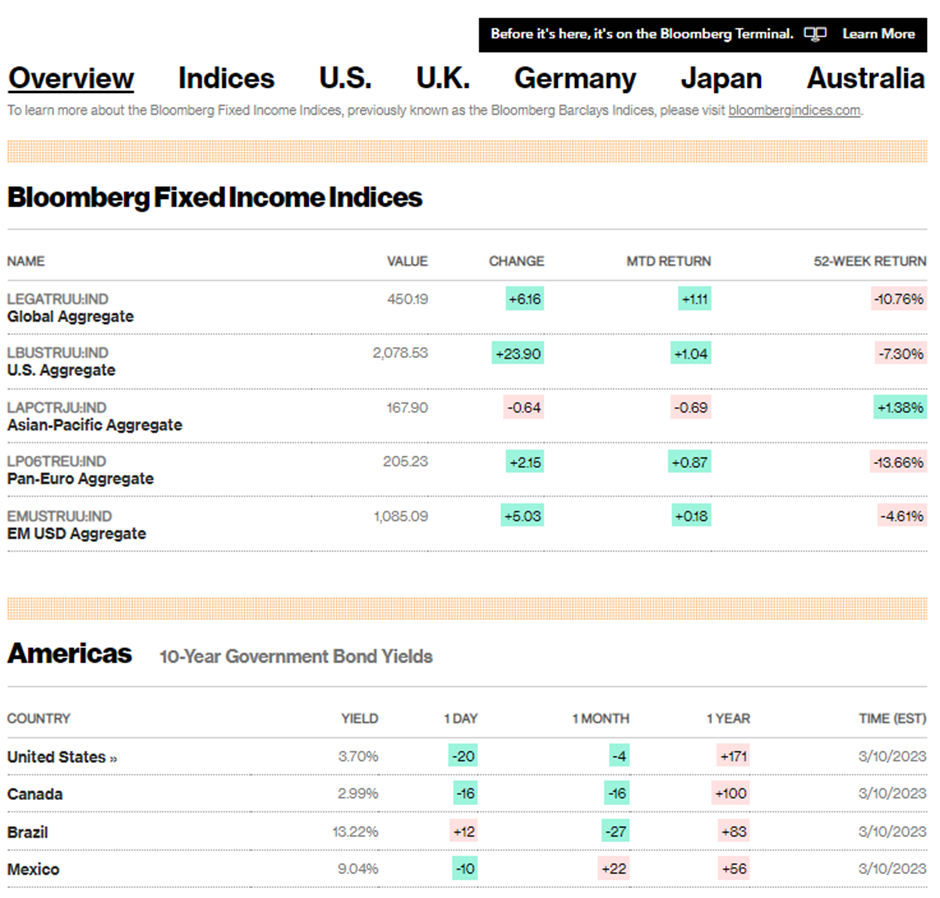

The stock market took a sharp downturn last week (S&P -1.45%, The Dow -1.07%, Nasdaq -1.63%), with concerns over inflation and the labor market weighing heavily on investors' minds. The S&P 500 Index fell to its lowest level since January 5, with small-caps underperforming large-caps and value stocks falling more than growth stocks. Financials were hit particularly hard, with SVB Financial's troubles (check out the explainer post on this) causing a sell-off in other regional banks. The market slide began after Fed Chair Jerome Powell testified before Congress on Tuesday, warning that policymakers were prepared to raise interest rates higher than expected to combat inflation. Despite strong job growth, wage growth cooled, with mixed signals from ADP's private sector employment tally and separate data on job openings. Friday's nonfarm payrolls report showed an increase in jobs (311k vs. 200k expected), but also a rise in the unemployment rate and average hourly earnings that were lower than expected by 0.2%. Speculation that SVB's troubles might lead the Fed to dial back interest rate hikes caused short-term Treasury yields to plummet and credit spreads to widen. The risk-off environment caused the yield on the benchmark 10-year U.S. Treasury note to drop and credit spreads to widen.

Japan

Despite a sell-off in Japanese bank stocks on Friday, following a slump in their U.S. peers, Japan’s stock markets saw modest gains for the week, with the Nikkei 225 Index up +0.78% and the broader TOPIX Index rising +0.60%. The Bank of Japan (BoJ) kept its accommodative monetary policy unchanged in March, causing the yield on the 10-year Japanese government bond (JGB) to sharply drop, finishing the week at 0.42%, down from 0.50% the previous week. The yen also weakened against the U.S. dollar at 136.7 due to the BoJ's dovish stance, stronger-than-expected U.S. economic data, and hawkish messaging from the Fed.

Outgoing BoJ Governor Haruhiko Kuroda chaired his last meeting, where the central bank made no changes to its monetary policy, keeping its key short-term interest rate on hold at -0.1% and reiterating its 0% target for 10-year JGB yields. Investors are now looking towards the BoJ’s April meeting, which will be the first under incoming Governor Kazuo Ueda. There is speculation that the BoJ may widen further the range in which JGB yields are allowed to fluctuate or abandon the yield curve control framework altogether.

Japan’s economic growth for the last three months of 2022 was downgraded to an annualized 0.1% quarter on quarter from a preliminary estimate of a 0.6% expansion. Private consumption fell short of estimates due to rising inflation curbing spending, and the government has been ordered to draft additional measures to counter price hikes and support Japan’s fragile post-COVID recovery by Prime Minister Fumio Kishida.

China

Chinese equities experienced a decline due to signs of weakening demand and a growth target that was lower than expected. The Shanghai Stock Exchange Index and the blue chip CSI 300 both experienced significant losses, with the former dropping by -2.95% and the latter by -3.96%. Similarly, the benchmark Hang Seng Index in Hong Kong plummeted by roughly -6%, marking its biggest weekly loss in over four months. Beijing unveiled an economic growth target of around 5% for 2023 at the National People Congress, which is China's parliament. This target lagged behind most forecasts but indicates an improvement from last year's 3% growth. Premier Li Keqiang also outlined plans for ensuring economic stability, expanding consumption, and making China a mid-level developed economy by 2035. Meanwhile, China's parliament approved a plan for a sweeping reform of central government institutions.

Economic data in China has been weaker than expected, with consumer price index and core inflation rising less than forecasted in February. Producer prices also fell due to lower commodity costs, which indicates that inflation in China remains muted. Additionally, Chinese exports and imports extended their decline in the first two months of the year, indicating a slowdown in global trade activity.

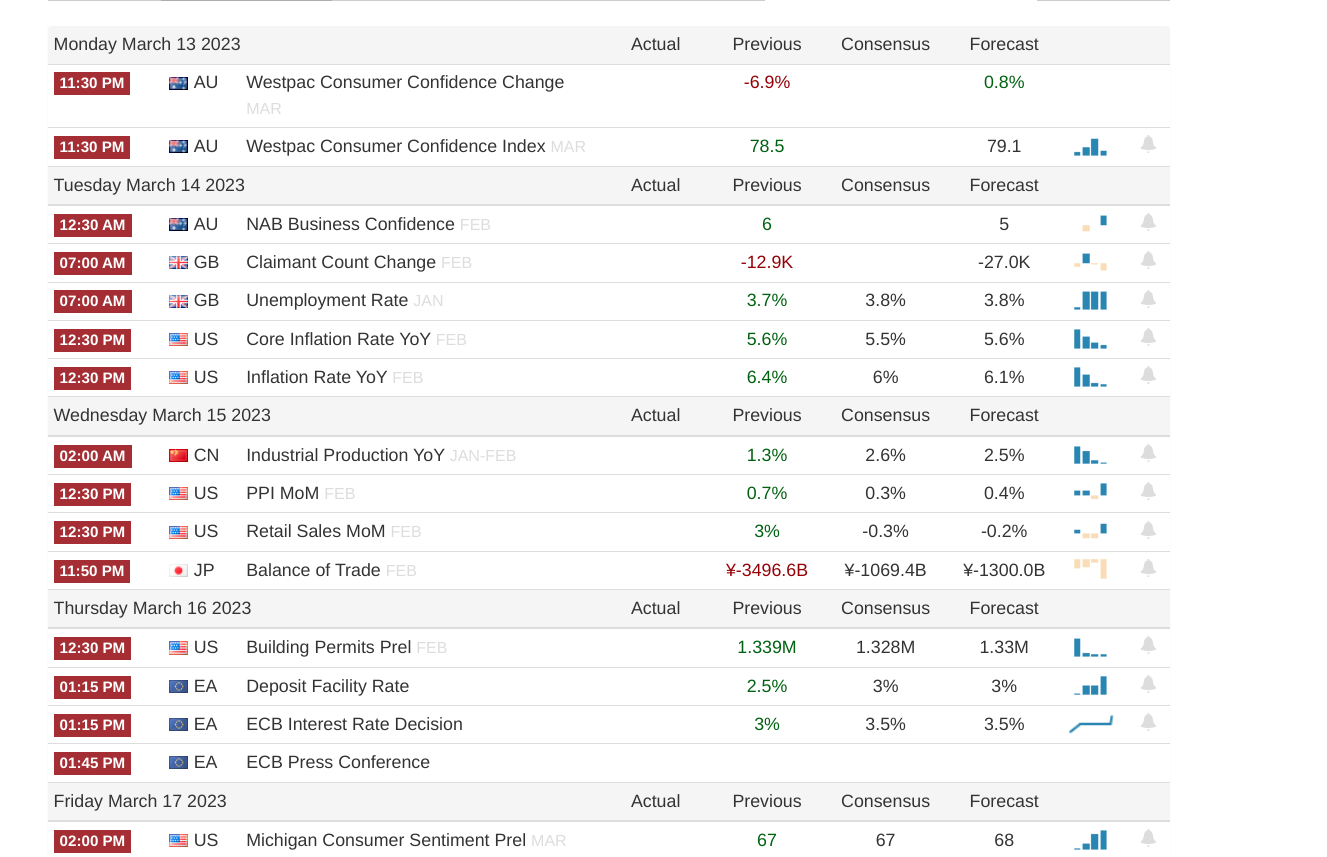

2. Week Ahead

- The February CPI release on Tuesday (Feb. 14). According to FactSet, Wall Street expects February CPI to rise 0.4% month-over-month and 6% on an annualized basis. That would be a slowdown from January's 0.5% and 6.4%. February PPI also comes out on Wednesday.

- Fed’s Blackout period: Starting tomorrow, a blackout (silence) period for Fed speakers begins. Next week there will be no remarks.

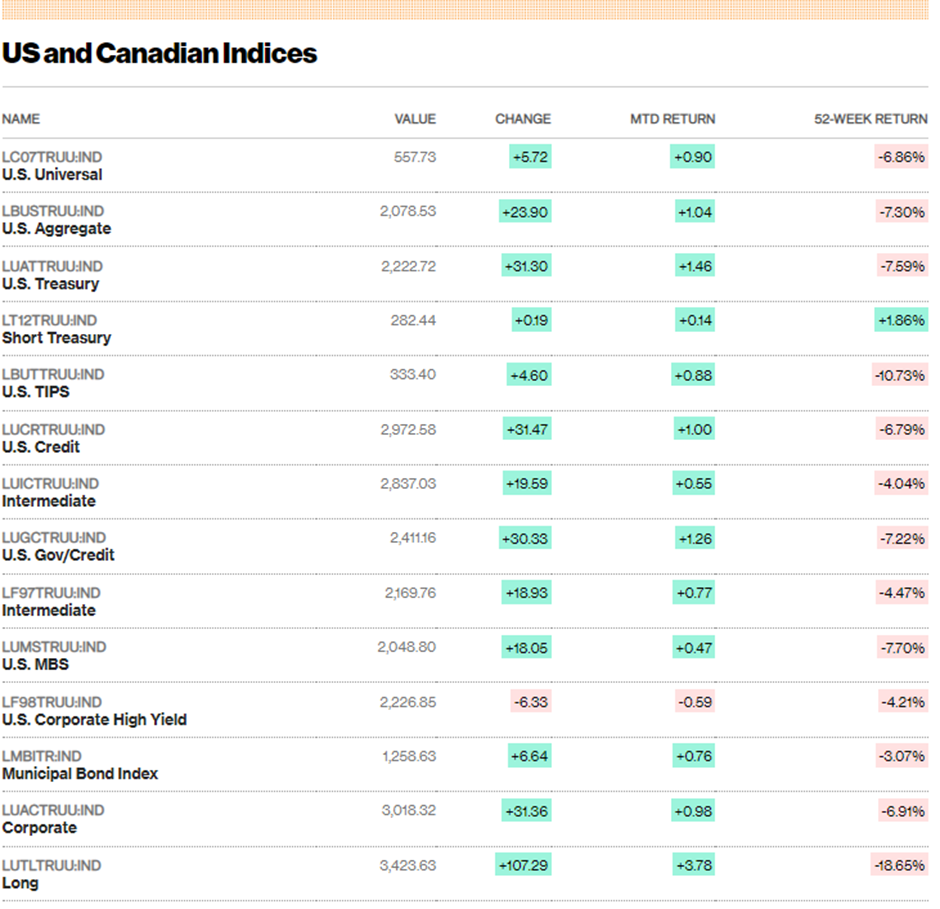

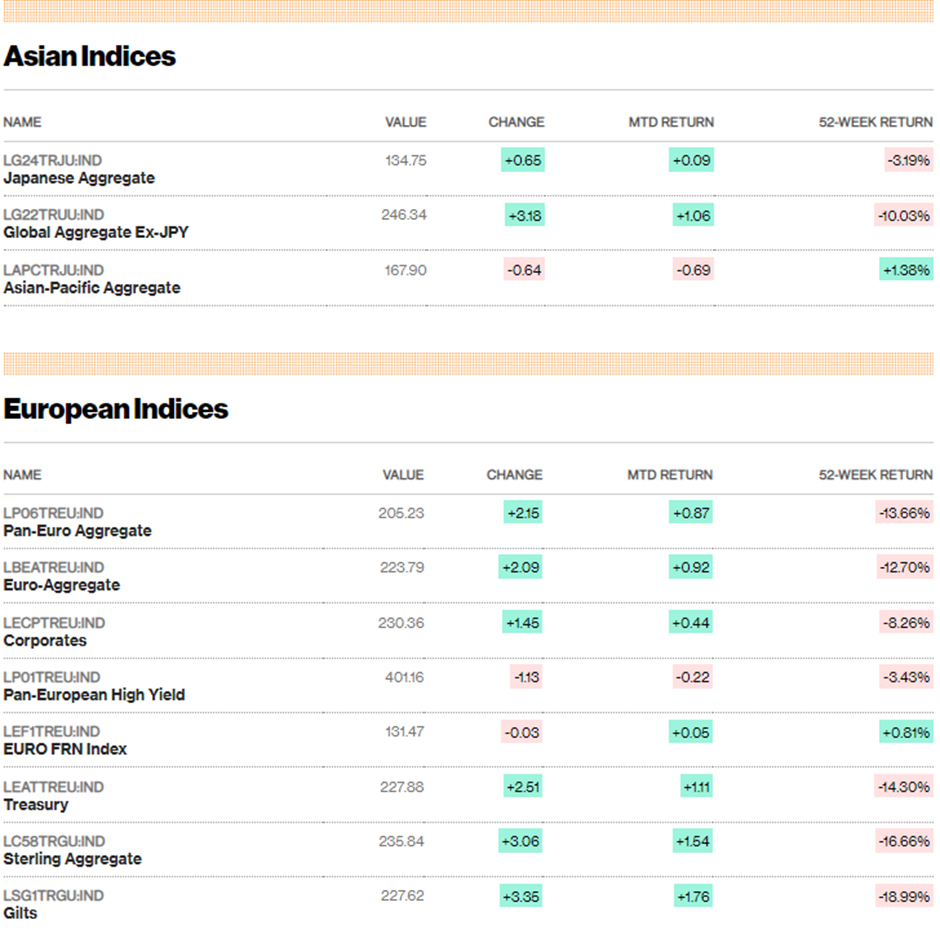

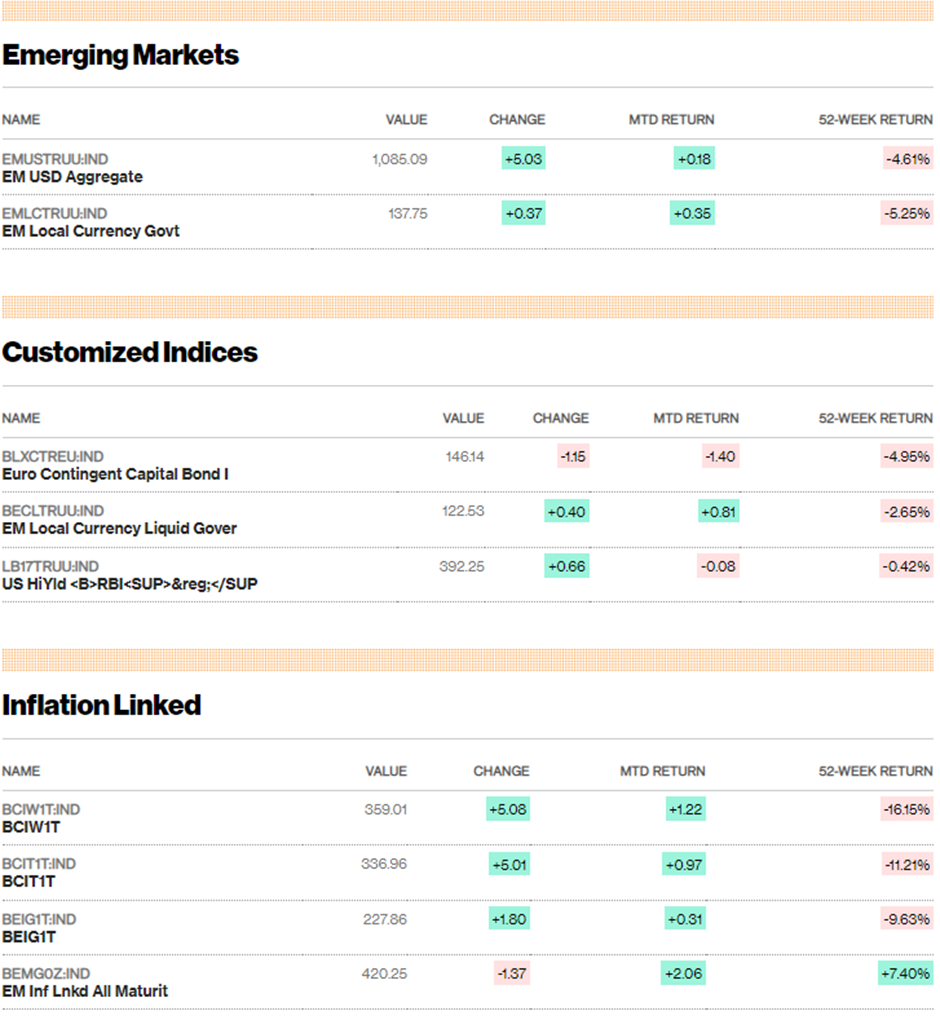

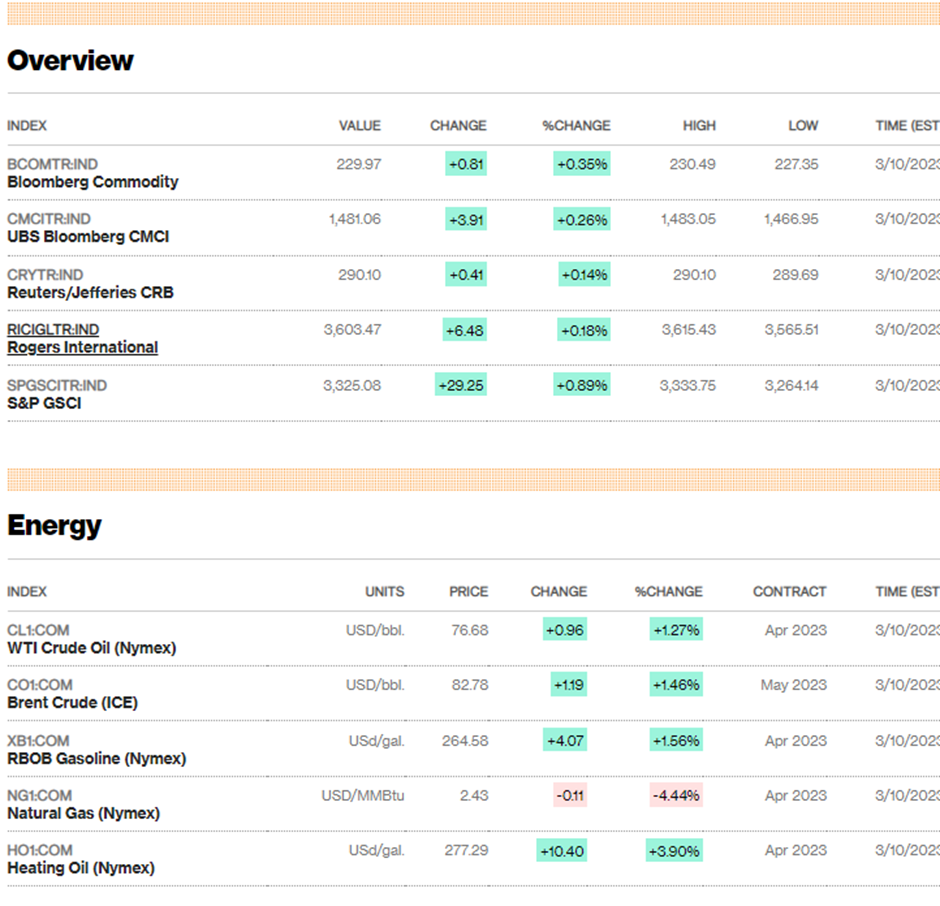

3. Bloomberg Market Data as of March 10 2023