Global Markets Recap - Week of May 15, 2023

1. What Moved the Markets?

Europe

European shares advanced during the week, driven by optimism that interest rates might be close to peaking and that the U.S. would avoid a debt default. The STOXX Europe 600 Index ended the week 0.72% higher, with Germany's DAX climbing 2.27% and France's CAC 40 Index gaining 1.04%.

European government bond yields rose as confidence in the European economy grew and there were signs of progress in U.S. debt ceiling negotiations. The yield on the 10-year German bond reached its highest level (2.5%) in over three weeks, and the benchmark 10-year UK gilt yield surpassed 4% as policymakers hinted at possible monetary tightening if inflationary pressures persist.

Eurozone industrial production declined more than expected, signaling a potential industrial recession. Industrial output fell 4.1% sequentially in March, with a year-over-year decline of 1.4%. German investor morale also fell for the third consecutive month in May, with concerns about rising interest rates. The European Commission raised its growth forecasts for the eurozone but predicted that inflation would remain high, driven by wage increases.

Bank of England Governor Andrew Bailey emphasized the need for further monetary tightening if inflationary pressures persist, noting that risks to inflation are skewed to the upside. The UK's unemployment rate rose slightly to 3.9%, but wage growth remained strong, with average weekly pay excluding bonuses increasing by 6.7% compared to the previous year.

Overall, European shares gained amid optimism about interest rates and U.S. debt negotiations. However, concerns about industrial recession and inflation persisted, influencing investor sentiment and bond yields. The Bank of England reiterated its focus on addressing inflationary pressures, while the UK's unemployment rate showed a slight increase alongside robust wage growth.

US

Stocks experienced solid gains during the week, with the S&P 500 Index surpassing the 4,200 level for the first time since late August. However, the market remained range-bound, with the index failing to move more than 1% for the sixth consecutive week. Mega-cap technology-related stocks, such as Alphabet (Google's parent company) and Meta Platforms (Facebook's parent company), outperformed, along with chipmakers like NVIDIA and Advanced Micro Devices. Regional bank shares also rallied. On the other hand, defensive sectors like consumer staples, healthcare, and utilities lagged.

The positive sentiment in the market was influenced by a shift in tone around debt ceiling negotiations. President Joe Biden expressed confidence in avoiding default, and both Republican and Democratic leaders showed willingness to reach a bipartisan deal. Economic data for the week generally met expectations, but surprises, such as slower retail sales growth and stronger industrial production, influenced investor reactions. The labor market showed resilience, with lower-than-expected weekly jobless claims and continuing claims reaching their lowest level in nine weeks.

Investors reacted to hawkish comments from Federal Reserve Chair Jerome Powell regarding inflation. While Powell emphasized the need to address high inflation, he also acknowledged the impact of recent banking turmoil on credit conditions, suggesting that the policy rate may not need to rise significantly to achieve the Fed's goals.

Bond yields rose during the week, driven by positive economic data, particularly in the jobs and manufacturing sectors. The municipal bond market faced pressure due to new deals and the sale of tax-exempt holdings by the FDIC. Investment-grade corporate bond issuance exceeded expectations, while the high yield market saw lower volumes influenced by debt ceiling news and Fed commentary.

Overall, the market experienced gains, influenced by improved sentiment in debt ceiling negotiations, mixed economic data, and market reactions to Fed commentary. Bond yields rose, impacting different segments of the bond market.

Japan

Japanese stock markets continued their upward trend, with the Nikkei 225 Index (+4.8%) and TOPIX Index (+3.1%) both posting their sixth consecutive weekly gains. The indexes reached near 33-year highs, supported by strong domestic earnings, a weaker yen, and foreign investors buying Japanese equities. The positive sentiment was further fueled by better-than-expected economic growth in the first quarter, driven by a revival in consumption following the easing of COVID restrictions. Additionally, hopes for a resolution on the U.S. debt ceiling added to investor optimism.

The yield on the 10-year Japanese government bond rose slightly to 0.39%, while the Bank of Japan (BoJ) remained committed to its ultra-loose monetary policy. The yen weakened against the U.S. dollar, but strong inflation data tempered some of its depreciation towards the end of the week.

Japan's first-quarter gross domestic product (GDP) expanded at an annualized rate of 1.6%, surpassing expectations. The growth was primarily driven by increased consumption as COVID restrictions were lifted, although net trade remained weak due to export challenges.

Despite higher consumer inflation, the BoJ reiterated its commitment to maintaining its accommodative stance. Japan's core consumer price index rose 3.4% year-on-year, exceeding the BoJ's 2% inflation target. However, the central bank emphasized the need to patiently sustain loose monetary policy, citing risks from a slowing global economy and uncertain wage growth. Governor Kazuo Ueda highlighted the high costs of premature policy shifts and the importance of waiting to ensure sustainable inflation levels.

Overall, Japanese stock markets experienced gains fueled by solid earnings, yen weakness, and positive economic data. The BoJ maintained its ultra-loose policy stance despite higher inflation, emphasizing the need for patience and stability in the face of economic uncertainties.

China

Chinese equities had a mixed performance as concerns grew over the country's post-COVID recovery losing momentum. The Shanghai Stock Exchange Index (+0.34%) and CSI 300 (+0.17%) recorded modest gains, while Hong Kong's Hang Seng Index declined (-0.90%). Official data revealed weaker-than-expected growth in industrial output, retail sales, and fixed asset investment in April compared to the previous year. Although unemployment fell slightly, youth unemployment reached a record high, raising concerns about the strength of the recovery's job market. Investors found the data disappointing, although the comparisons were influenced by the lockdown period in the previous year.

The People's Bank of China injected RMB 125 billion into the banking system through its one-year medium-term lending facility, indicating a commitment to maintain credit growth and liquidity. The central bank's quarterly monetary policy report also suggested the likelihood of further easing measures in the future.

China's currency, the yuan, depreciated at its fastest pace in nearly three months, influenced by signs of slowing growth and the strength of the U.S. dollar. The yuan weakened after the People's Bank of China set its central parity rate below RMB 7 per dollar for the first time since December.

In the housing market, new home prices in major Chinese cities continued their upward trend for the fourth consecutive month, although the growth rate slowed compared to the previous month. The slowdown in price gains followed a sharp decline in property investment and sales in April, raising concerns about the health of this critical sector for China's economy.

Overall, Chinese equities faced mixed performance as concerns about the country's economic recovery losing steam emerged. Weaker-than-expected economic indicators, a depreciating yuan, and a slowdown in the property market contributed to investor uncertainty. The People's Bank of China's commitment to maintaining liquidity and potential easing measures reflected the authorities' efforts to support economic growth.

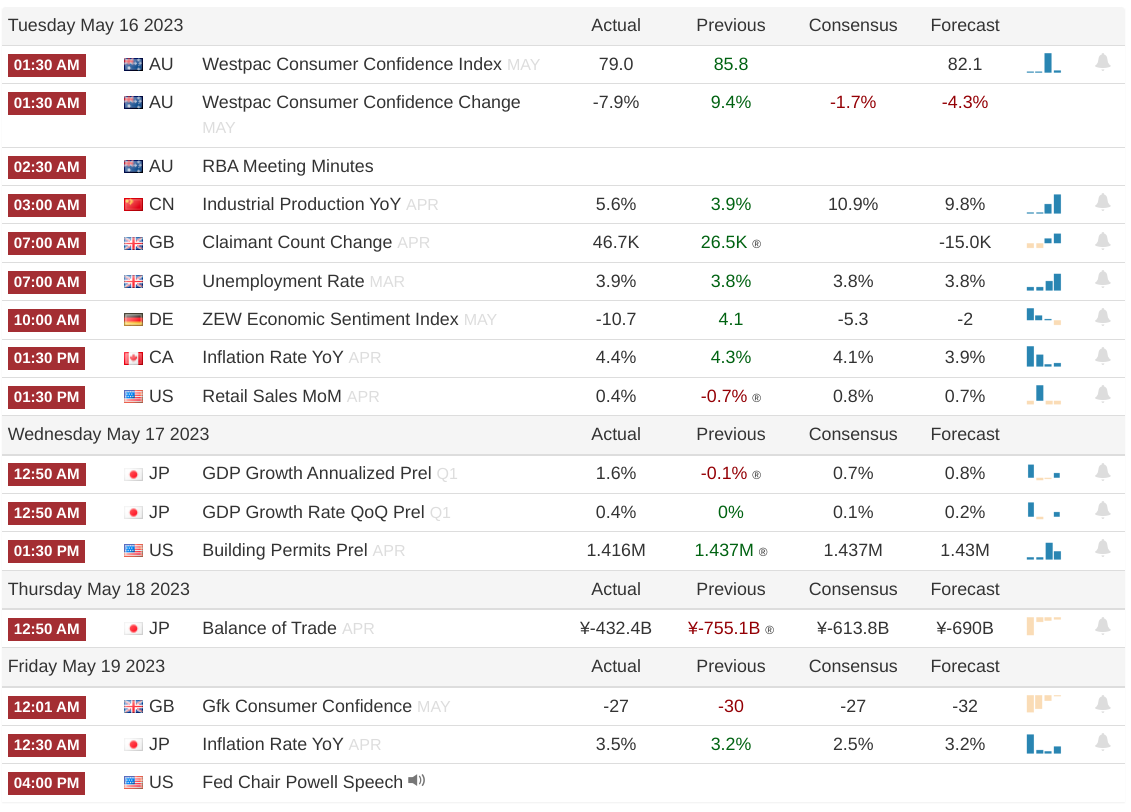

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)