Global Markets Recap - Week of June 5, 2023

Hello, everyone! Hope the summer is treating you well. I have been on holiday and recently came back. Thanks for understanding and here is the market recap!

1. What Moved the Markets?

Europe

The pan-European STOXX Europe 600 Index ended slightly lower (-0.46%) as investors exercised caution ahead of central bank meetings in Europe and the U.S. Major stock indexes in Germany (+0.63%) and France declined (-0.79%), while Italy's index gained (+0.35%) and the UK's FTSE 100 lost ground (-0.59%).

European Central Bank (ECB) officials indicated that interest rates are likely to rise in June, but there was less agreement on subsequent rate increases. While ECB President Christine Lagarde and Bundesbank chief Joachim Nagel maintained a hawkish stance, Dutch central bank Governor Klaas Knot appeared less hawkish, suggesting that rate decisions should be taken step by step.

The eurozone entered a mild recession as revised data showed a sequential contraction of 0.1% in the first quarter of the year and the final three months of 2022. Retail sales in the eurozone remained flat, indicating weak consumption, and Germany's industrial sector continued to deteriorate with a decline in factory orders. -0.4% compared vs. March's.

In the UK, house prices experienced a significant decline in April, raising concerns about the weakening housing market. However, measures of house prices, new inquiries, and sales agreements showed some improvement in May, albeit remaining in negative territory according to the Royal Institution of Chartered Surveyors.

US

The S&P 500 Index entered a bull market, rising more than 20% from its mid-October lows. Small-cap stocks outperformed large-caps, and value shares outperformed growth stocks. The equally weighted S&P 500 Index also outperformed the capitalization-weighted index for the first time in eight weeks. Several investment conferences and events, including the Paris Air Show and energy and consumer stock conferences, influenced market sentiment. Apple's annual developer's conference featured the unveiling of a virtual reality headset, which initially caused a negative investor reaction due to its high price but later recovered. Jobless claims reached their highest level since October 2021, while economic optimism for the next six months fell to its lowest level since November. The services sector contracted, but services prices declined. Longer-term Treasury yields rose slightly, and tax-exempt municipal bonds saw adequate demand. The investment-grade corporate bond market experienced increased issuance, and some high yield investors reduced exposure to BB rated bonds while seeking lower-rated securities with higher yields.

Japan

Japanese stock markets reached fresh 33-year highs, with the Nikkei 225 Index gaining 2.4% and the TOPIX Index up 1.9%. The positive sentiment was driven by an upward revision in Japan's first-quarter economic growth, primarily due to stronger corporate investment. Hopes for the services sector to benefit from rebounding foreign inbound tourism also contributed to the optimism.

The yen remained close to a six-month low against the U.S. dollar, influenced by the monetary policy divergence between the dovish Bank of Japan (BoJ) and other major central banks. The weak yen continued to benefit exporters and made local assets more attractive to foreign investors. Japanese financial authorities stated their vigilance in monitoring currency market movements and readiness to respond appropriately.

Uncertainty prevailed ahead of the BoJ's June monetary policy meeting, and the yield on the 10-year Japanese government bond saw a slight increase. Expectations of changes in the BoJ's yield curve control framework diminished as the central bank emphasized its commitment to patient monetary easing until achieving the 2% price stability target and wage increases.

Revised figures showed that Japan's economy grew by 2.7% on an annualized basis in the first quarter, surpassing the initial estimate of 1.6%. The upward revision was attributed to stronger corporate investment despite concerns about global and Chinese economic slowdowns.

China

Chinese equities had mixed performance as concerns grew over the country's post-pandemic recovery. The Shanghai Stock Exchange Index rose by 0.04%, while the blue chip CSI 300 declined by 0.65%. In Hong Kong, the Hang Seng Index extended its gains from the previous week, rising by 2.32%.

May's inflation data indicated rising deflation risks in China's economy. The consumer price index grew by 0.2% YoY, compared to April's 0.1% expansion, which was a 26-month low. Core inflation, excluding volatile food and energy prices, slowed to 0.6% from the previous month's 0.7%. The producer price index experienced a worse-than-expected decline of 4.6%, accelerating from April's 3.6% decline and marking the weakest reading since May 2020.

On a positive note, the private Caixin/S&P Global survey revealed solid growth in the services sector, reaching its fifth consecutive monthly expansion since pandemic restrictions were lifted in December. The Caixin survey of manufacturing activity also unexpectedly rose. However, the official manufacturing Purchasing Managers' Index contracted for a second consecutive month.

China's exports fell 7.5% in May, the first decline in three months, reflecting weakening global demand. Imports also shrank, albeit above forecasts.

Given the latest data, expectations rose for the People's Bank of China (PBOC) to introduce additional support measures to boost growth. Economists predict that the PBOC may reduce the reserve requirement ratio and interest rates later in the year to stimulate demand amid signs of a slowdown in the post-pandemic recovery.

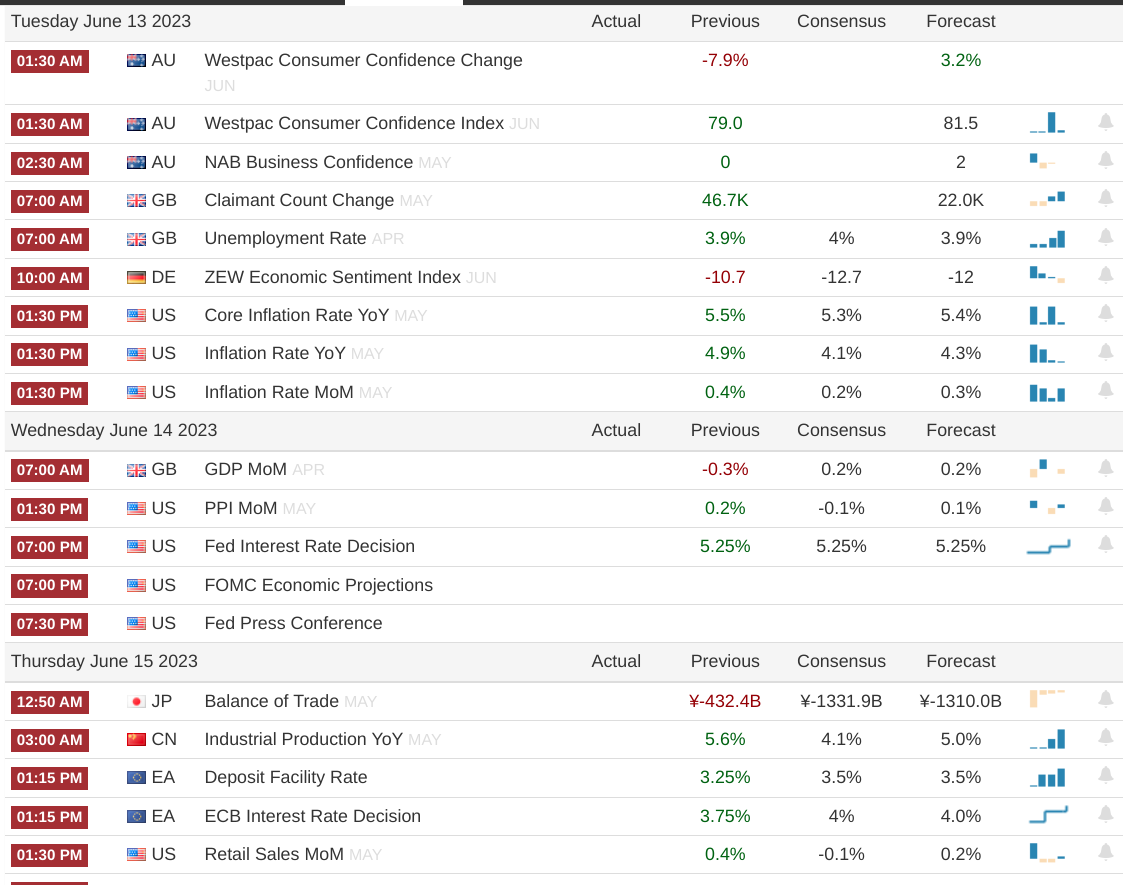

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](https://images.unsplash.com/photo-1657408056887-c8c627f7574a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fHN0YWJsZWNvaW58ZW58MHx8fHwxNzY0NzM0MTExfDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)