Global Markets Recap - Week of May 1, 2023

1. What Moved the Markets?

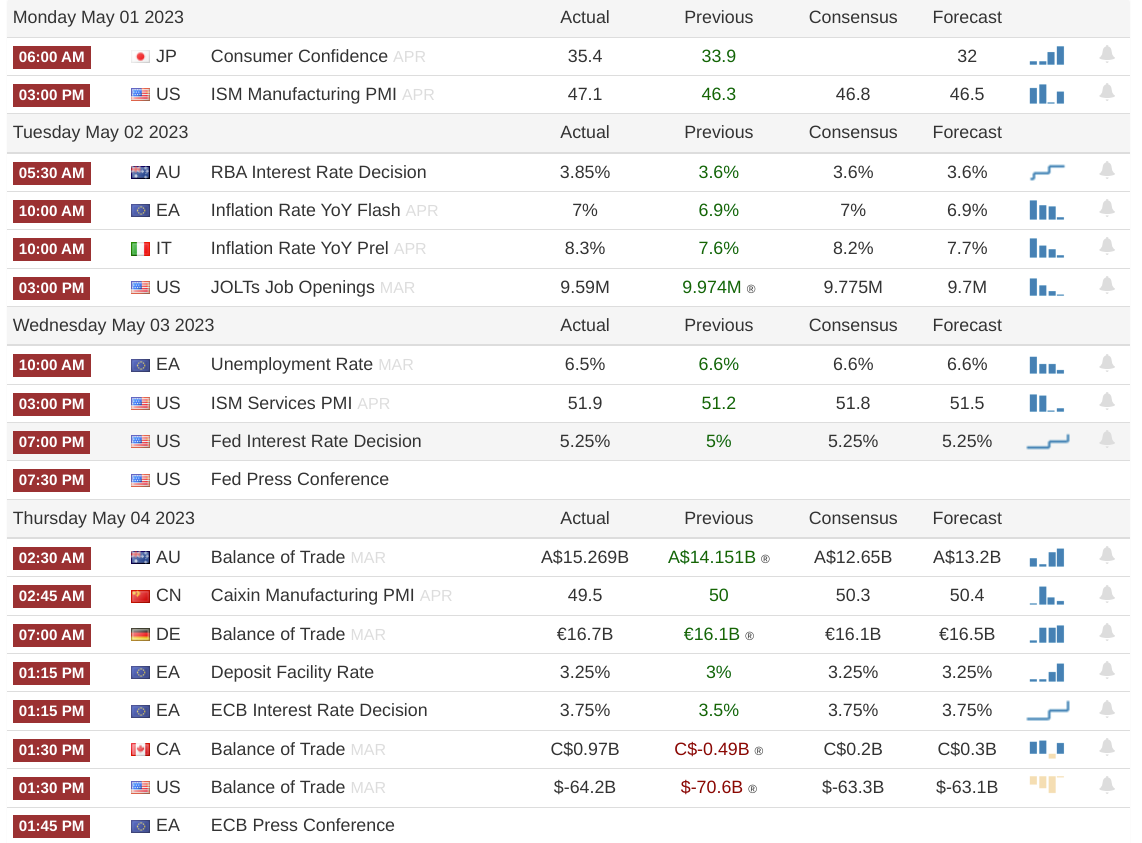

Europe

During the week, the pan-European STOXX Europe 600 Index closed 0.28% lower as recession concerns and banking issues continued to impact market sentiment. Major European stock indexes had mixed performances, with Germany's DAX slightly up by 0.24%, France's CAC 40 weakening by 0.78%, and the UK's FTSE 100 sliding 1.17%.

European government bond yields decreased following the European Central Bank's (ECB) decision to raise interest rates by 0.25%, a reduction from previous 0.5% increases. The yield on 10-year German government debt reached nearly one-month lows. In the UK, yields remained largely unchanged, near one-month highs of around 3.8%, as investors anticipated further tightening from the Bank of England.

The ECB slowed down its pace of interest rate increases, raising the key deposit rate by 0.25% to 3.25%, as anticipated. The bank also announced the cessation of its bond purchase reinvestment program by July. ECB President Christine Lagarde stated that interest rates would rise to "sufficiently restrictive levels" until inflation reaches the 2% target. While some policymakers argued for a 0.5% increase, the Governing Council expressed concerns about the banking industry's instability and its impact on credit availability for the economy. Lagarde emphasized that the rate hikes would continue, stating that there is more ground to cover.

In the eurozone, inflation accelerated to 7.0% year over year in April, up from 6.9% in March, according to official data. However, the core inflation rate, which excludes volatile components, unexpectedly declined to 5.6%. The labor market tightened, with the jobless rate dropping to 6.5% in the region, and Germany's jobless rate reaching its lowest level among European Union members at 2.8%.

The UK housing market showed signs of stabilization in March, with mortgage approvals for home purchases increasing for the second consecutive month. However, with 52,011 mortgages approved, the numbers are still below the pre-crisis average of around 70,000. The market was affected by a proposal under former Prime Minister Liz Truss that caused interest rates to rise and led lenders to withdraw funds from the market.

Norway's central bank, Norges Bank, raised its key interest rate by 0.25% to 3.25% in an effort to control inflation. The bank stated the possibility of another rate hike in June if the currency remained weak.

US

Despite a brief rally on Friday, the S&P 500 Index ended the week with a decline. This was driven by comments from Federal Reserve Chair Jerome Powell, indicating a slower-than-expected pace of interest rate cuts, which disappointed the market. Additionally, concerns over raising the U.S. debt ceiling added to the uneasiness, as Treasury Secretary Janet Yellen warned that the government might not be able to meet its debt obligations as early as June 1. Among the sectors in the S&P 500, the information technology sector performed well and finished the week on a positive note. However, energy shares declined in response to the decrease in the price of West Texas Intermediate crude oil.

Yields on 10-year U.S. Treasuries initially fell due to concerns about regional banks and the debt ceiling, but they moderated during Friday's trading session. It's worth noting that when bond prices go down, yields go up, and vice versa. There was subdued activity in the high yield market, as investors evaluated the risks associated with regional banks and the Federal Reserve's stance on interest rates. Trade volumes remained low before and after the central bank's widely anticipated rate increase was announced. The week was marked by a flurry of new deals being announced, making it a busy period for issuance.

Renewed volatility in regional banks arose after First Republic Bank, based in California, was taken under regulatory control due to deposit outflows. Concerns about potential bank failures and credit pressures in an economic slowdown contributed to significant volatility in the regional banks subsector of the S&P 500.

As anticipated, the Fed raised interest rates by 25 basis points, indicating a target range of 5.00% to 5.25%. The Fed's statement emphasized that future actions would depend on incoming data and economic developments, with Chair Powell hinting that the fed funds rate may be nearing its peak for this cycle. However, he did not rule out further tightening, stating that rate cuts would not be appropriate unless inflation decreases quickly.

While the number of job openings decreased for a third consecutive month in March, indicating a decline in small businesses, the labor market remained tight with more job openings than unemployed individuals. The nonfarm payrolls report for April showed strength in the labor market, with higher job gains and an increase in average hourly earnings compared to the previous month.

Japan

Japan's stock markets experienced gains in the first two days of the week before closing for the Golden Week national holidays. The Nikkei 225 Index rose by 1.0%, and the broader TOPIX Index increased by 0.9%. Monday's rally was driven by a sell-off in the yen, which positively impacted the prospects of Japanese exporters. The Bank of Japan's decision to maintain its accommodative monetary policy during its April meeting further supported market sentiment.

However, over the entire week, the yen strengthened against the U.S. dollar, moving from approximately JPY 136.3 to JPY 134.1. The yen benefited from safe-haven demand due to concerns about a potential U.S. recession, ongoing issues with certain U.S. regional banks, and signals from the U.S. Federal Reserve indicating a pause in interest rate hikes. Meanwhile, the yield on the 10-year Japanese government bond remained relatively stable at 0.42%.

Economy Minister Shigeyuki Goto stated in an interview with Reuters that problems in the banking sectors of the U.S. and Europe are not expected to have an immediate impact on Japan's economy and financial system. He also expressed his expectation for the Bank of Japan to adopt a flexible and appropriate monetary policy, considering the state of the economy and financial markets.

In a move to normalize social and economic activities, the Japanese government announced that COVID-19 would be reclassified to a level similar to seasonal influenza from May 8. This decision was made based on the advice of infectious disease experts who assessed the current pandemic situation and the healthcare system's readiness for a potential resurgence of cases. The reclassification follows the lifting of remaining border control measures related to the coronavirus before the Golden Week holidays.

China

Chinese equities had a mixed performance in a holiday-shortened week as weaker-than-expected manufacturing data affected market sentiment. The Shanghai Stock Exchange Index increased by 0.34%, while the blue-chip CSI 300 declined by 0.3% in local currency terms. Mainland China's financial markets were closed from Monday to Wednesday due to the Labor Day holiday.

In April, China's official manufacturing purchasing managers' index (PMI) dropped to 49.2 from March's 51.9, indicating a return to contraction for the first time since December when Beijing shifted away from its zero-COVID policy. The non-manufacturing PMI also softened in April but remained above the 50 threshold that separates growth from contraction. Additionally, the private Caixin/S&P Global survey showed a decline in manufacturing activity, with the index falling to 49.5 in April from 50.0 in March due to subdued global demand. The survey of services activity also weakened but remained in expansion territory for the fourth consecutive month. The downturn in factory activity in both surveys raised concerns about the momentum of China's post-COVID recovery.

During the five-day holiday, domestic tourism rebounded to pre-pandemic levels. The Ministry of Culture and Tourism reported approximately 274 million trips taken from Saturday to Wednesday, representing a significant increase of around 71% compared to the previous year. Spending during the holiday period also surged by approximately 129% compared to the same period last year. These figures provided optimism that a sustained recovery in the services sector could offset the weaknesses in the manufacturing sector and the fragile property market recovery.

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)