Global Markets Recap - Week of May 8, 2023

1. What Moved the Markets?

Europe

The STOXX Europe 600 Index ended the week relatively flat as investors digested the possibility of further rate increases by the European Central Bank (ECB). Major European stock indexes posted mixed results, with France's CAC 40 and Germany's DAX slightly declining, and the UK's FTSE 100 slipping as well.

ECB President Christine Lagarde hinted at more rate increases, stating that while the bank has taken decisive action against inflation, there is still more to be done due to potential upside risks. Economist Tomasz Wieladek suggested that the ECB could raise its deposit rate beyond current expectations if inflationary pressures persist. He also mentioned that progress in U.S. debt ceiling talks may influence the ECB's decisions.

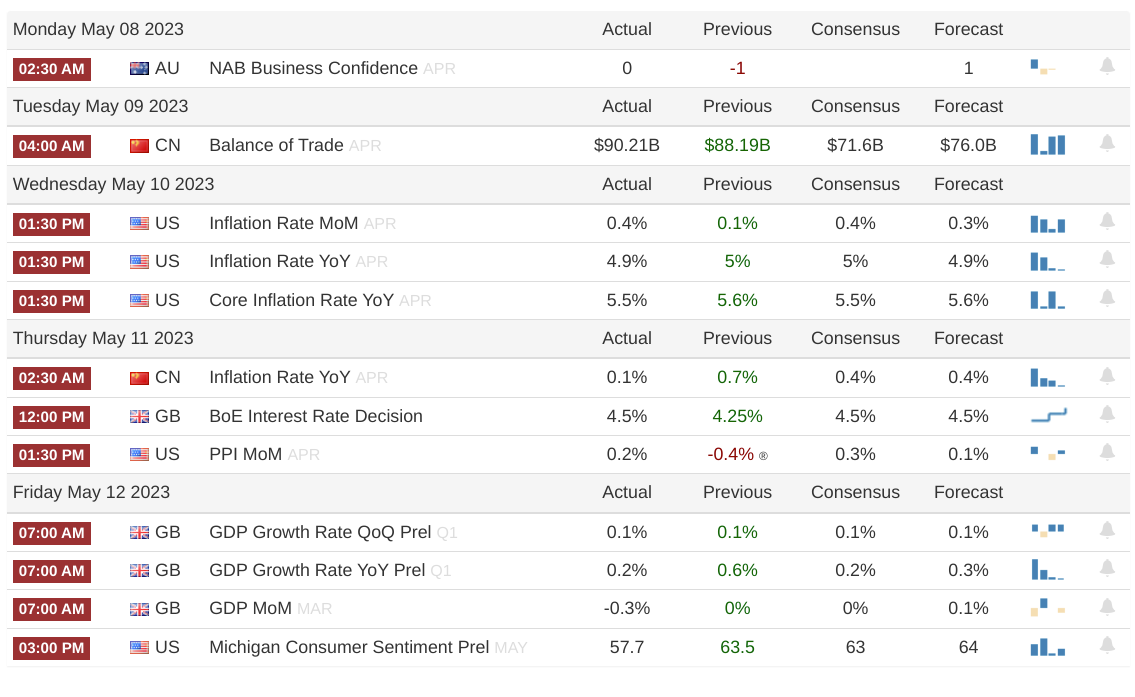

German manufacturing orders in March contracted more than expected, raising concerns about a possible recession in the country. On the other hand, the Bank of England (BoE) increased its key interest rate to 4.25%, the highest level since 2008, and revised its inflation and economic growth forecasts. The UK economy narrowly avoided a forecasted recession by growing 0.1% in the first quarter, but GDP in March unexpectedly fell by 0.3% sequentially.

Overall, the European markets remained cautious amid rate increase speculations, mixed economic data, and uncertainties regarding inflation and growth prospects.

US

The week ended with mixed results for major stock indexes as investors weighed inflation data. The technology-heavy Nasdaq Composite performed well, boosted by Alphabet's new AI-based search platform. However, the Dow Jones Industrial Average lagged behind due to a decline in Disney+ subscribers. Concerns over regional banks affected the financial sector. Trading volumes were low, reaching the lowest level of the year. Inflation data revealed that headline consumer prices rose 4.9% over the year, slightly below expectations. Core inflation, excluding food and energy prices, met expectations, but "supercore" inflation, measuring services inflation without housing costs, had the lowest reading in nearly three years. Despite the data, Federal Reserve officials maintained their inflation and interest rate expectations. There were concerns about the approaching deadline to increase the debt ceiling, and an agreement with spending caps and a debt ceiling extension was anticipated. A jump in consumers' inflation expectations caused stocks to decline and bond yields to rise, with expectations of annual inflation running at 3.2% over the next five years. Investment-grade corporate bonds saw increased demand from Asia, while the consumer price data supported the high yield market.

Japan

Japan's stock markets experienced support from strong corporate earnings, resulting in the Nikkei 225 Index rising 0.8% and the broader TOPIX Index increasing by 1.0%. However, concerns about China's economic growth and the U.S. debt ceiling dampened sentiment. Data revealed sluggish wage growth in March, aligning with the Bank of Japan's dovish stance. As a result, the yield on the 10-year Japanese government bond declined, and the yen slightly strengthened against the U.S. dollar.

Investors closely monitored the Bank of Japan's stance on monetary policy, with Governor Kazuo Ueda stating that the central bank aims to end yield curve control and reduce its balance sheet once sustainable and stable 2% inflation is achieved. Wage growth remains a concern, as data showed minimal growth in workers' nominal wages and a decline in real wages. The Bank of Japan emphasizes the need for wage increases to accompany the achievement of its price stability target.

Opinions gathered during the Bank of Japan's April meeting indicated positive developments in wage negotiations, but the sustainability of these wage increases, particularly for smaller firms, remains uncertain. A survey of over 300 companies suggested that average wages in 2023 are expected to rise significantly, but there are concerns about the breadth and inclusiveness of these increases.

Overall, the Japanese stock market benefited from strong corporate earnings, but concerns over external factors and sluggish wage growth persist, influencing monetary policy considerations.

China

Chinese equities faced a decline in the first week of trading after the Labor Day holiday as concerns grew regarding the strength of the country's economic recovery. The Shanghai Stock Exchange Index and the blue chip CSI 300 both experienced losses, while the Hang Seng Index in Hong Kong also declined.

China's consumer price index (CPI) showed a modest increase of 0.1% in April compared to the previous year, lower than March's 0.7% rise and below economists' expectations. Core inflation, which excludes volatile food and energy prices, remained unchanged, indicating limited demand-driven inflation in the economy. The producer price index fell by a larger-than-expected 3.6%, reaching its lowest level since May 2020. These figures raised concerns of a potential deflationary period and fell short of the government's 2023 inflation target of around 3%. Additionally, new bank loans decreased significantly, reflecting lower credit demand.

The latest data supported expectations that China's central bank may implement policy easing in the near future to support the economy, which has shown signs of losing momentum after a post-pandemic rebound. As a result, the yield on China's 10-year government bond reached its lowest level since November, as traders anticipated further monetary easing.

On the trade front, China's exports experienced 8.5% growth in April compared to the previous year, a slowdown from March's 14.8% increase. However, imports declined by a larger-than-expected 7.9% after a 1.4% decrease in the previous month. These figures added to concerns about economic growth following disappointing manufacturing and services activity readings in the prior week. China's official manufacturing Purchasing Managers' Index unexpectedly contracted in April, marking the first contraction since December when the country shifted its COVID-19 policy.

Overall, the weak economic data in China raised concerns about the country's recovery, leading to a decline in equities. Expectations of further monetary easing by the central bank were reinforced, aiming to support the economy and address the loss of momentum in the post-pandemic rebound.

2. Week Ahead