What does 'Trump 2.0' mean for Sustainable Investing?

(More comprehensive version coming up soon, but sneak peek into what's coming below!)

Hi All,

Indeed, the wheel has started to turn, and the past three weeks since Trump's inauguration have been a whirlwind of executive orders and shock waves reverberating across the global system. I would caution against speculation, but I've been talking to friends in Washington D.C. and the incoming Trump administration and wanted to share some quick thoughts - we should closely monitor the ramifications of tariffs, geopolitics, and AI development on sustainable finance in both private and public markets.

President Trump Participates in the FII PRIORITY Summit (Feb 19, 2025)

President Trump's administration has signaled a robust shift toward fossil fuel energy policies. On his first day in office, he declared a national energy emergency, issuing executive orders aimed at rolling back climate policies established by previous administrations. These orders have put carbon emissions standards, electric vehicle incentives, and building energy efficiency standards into question. The administration's focus is on removing barriers to fossil fuel and mineral exploration and production, alongside a renewed withdrawal from the Paris Agreement.

The appointment of key figures underscores this policy direction. Notably, Chris Wright, a prominent figure in the oil industry, has been appointed as the Secretary of Energy. Wright's background suggests a prioritization of fossil fuel development over renewable energy initiatives.

I. Policy Shifts and Regulatory Landscape

Upon re-assuming office, President Trump initiated a series of executive actions signaling a decisive shift toward fossil fuel energy policies:

- National Energy Emergency Declaration: On his first day, President Trump declared a national energy emergency, issuing executive orders aimed at dismantling climate policies established by previous administrations. These orders have put carbon emissions standards, electric vehicle incentives, and building energy efficiency standards into question.

- Establishment of the National Energy Dominance Council: An executive order established this council to expedite oil and gas production, streamline regulatory processes, and promote fossil fuel energy projects.

- Withdrawal from the Paris Agreement: The administration has renewed its withdrawal from the Paris Agreement, distancing the U.S. from international climate commitments.

- Revocation of Environmental Protections: Protections for vast areas of federal waters have been rescinded, opening them to oil and gas drilling.

- Rollbacks on Renewable Energy Support: The administration has frozen green spending programs and rolled back incentives for renewable energy projects, including subsidies for electric vehicles.

- On IRA: President Trump's second term has introduced significant policy shifts with profound implications for the Inflation Reduction Act (IRA) and international trade. On his first day back in office, he signed executive orders halting over $300 billion in federal green infrastructure funding, effectively suspending disbursements for projects under the IRA and the bipartisan infrastructure law. This abrupt cessation has created uncertainty for numerous clean energy and infrastructure initiatives, potentially stalling progress in sectors that had been poised for growth under the previous administration.

- In tandem with these domestic policy changes, President Trump has announced a series of tariffs aimed at reshaping international trade relations. Notably, he has imposed a 25% tariff on imports from Canada and Mexico, with a slightly reduced 10% tariff on Canadian energy imports. Additionally, a 10% tariff has been levied on imports from China. These measures are intended to address trade imbalances and protect domestic industries but have raised concerns about potential retaliatory actions and the broader impact on global supply chains.

- The intersection of these policy decisions suggests a challenging landscape for sustainable finance and international trade. The suspension of IRA funding may deter investment in renewable energy and infrastructure projects, while the new tariffs could lead to increased costs for consumers and businesses, potential trade disputes, and a reevaluation of global supply chains. Stakeholders in both the public and private sectors will need to navigate this evolving environment carefully, balancing the administration's protectionist policies with the imperatives of sustainable development and international cooperation.

II. Implications for Sustainable Finance

The administration's policy direction presents several challenges and considerations for sustainable finance:

- Regulatory Uncertainty: The potential repeal of climate-related regulations introduces significant uncertainty for investors in renewable energy and sustainable projects. This uncertainty may deter investment and stall projects in the US reliant on federal support.

- Market Dynamics: While federal support for fossil fuels may increase, market dynamics such as global demand, technological advancements, and state-level policies continue to favor renewable energy. Investors should consider these factors when evaluating long-term opportunities.

- Corporate Sustainability: Despite federal policies, many corporations maintain sustainability goals independent of federal directives, creating a demand for green financing solutions.

III. Energy Transition and Investment Opportunities

The global energy transition is influenced by multiple factors beyond U.S. federal policies:

- International Commitments: While the U.S. may retreat from certain climate agreements, other nations are likely to reaffirm their commitments, potentially leading to international investment opportunities in sustainable infrastructure.

- Technological Advancements: Ongoing innovations in renewable energy and energy storage technologies continue to drive down costs, making sustainable projects increasingly competitive.

- State and Local Initiatives: Despite federal rollbacks, numerous states and municipalities remain committed to clean energy transitions, offering alternative avenues for investment in sustainable projects.

IV. Strategic Considerations for Investors

Given the evolving landscape, investors should:

- Diversify Portfolios: Balance investments across traditional and renewable energy sectors to mitigate policy-driven risks.

- Engage in Policy Advocacy: Participate in dialogues at state and local levels to support favorable policies for sustainable finance.

- Monitor Global Trends: Stay informed on international climate policies and market developments to identify emerging opportunities.

In conclusion, while Trump 2.0 introduces challenges to climate policy and sustainable finance, a multifaceted approach that considers regulatory changes, market dynamics, and technological progress can help investors navigate this complex environment.

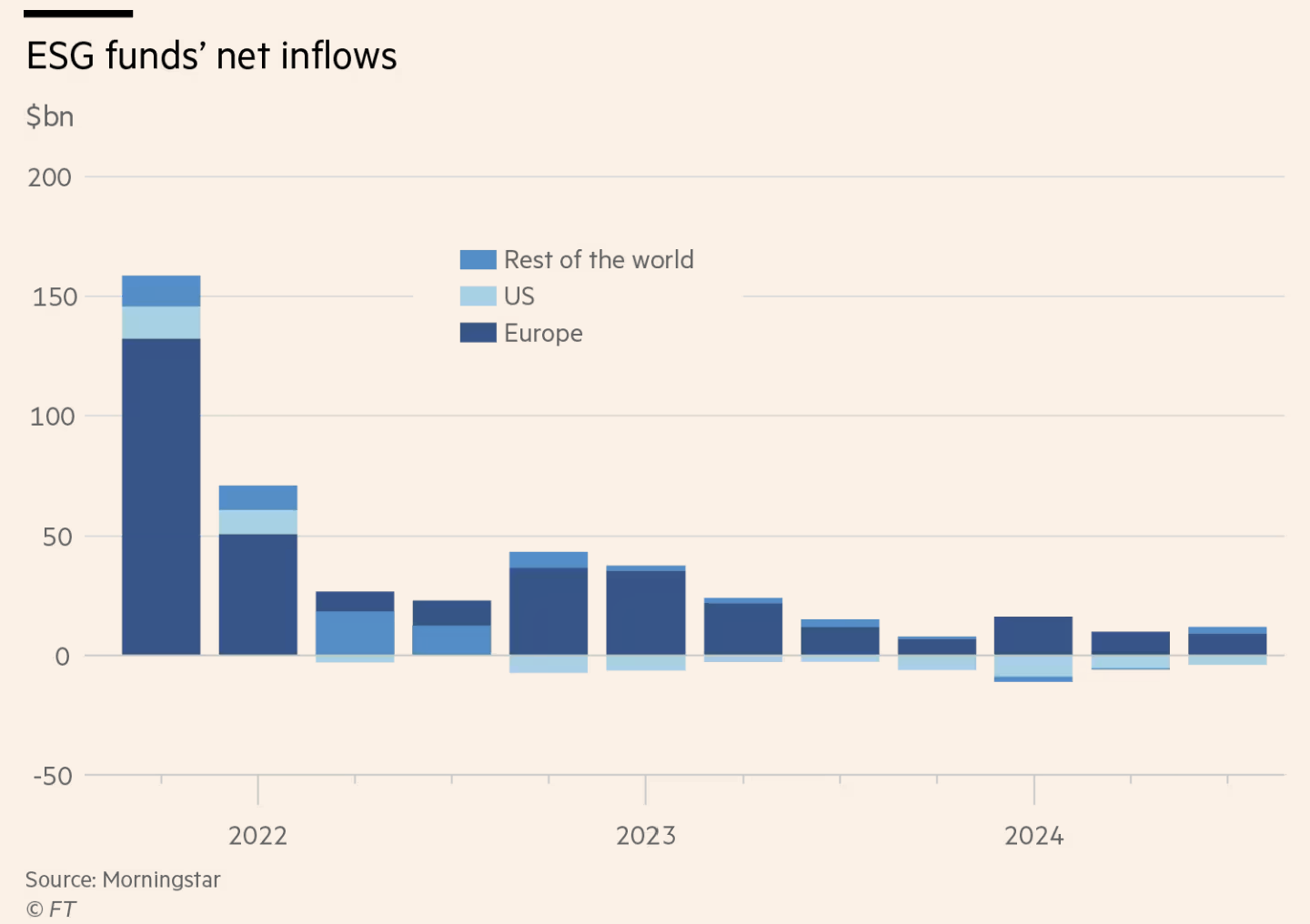

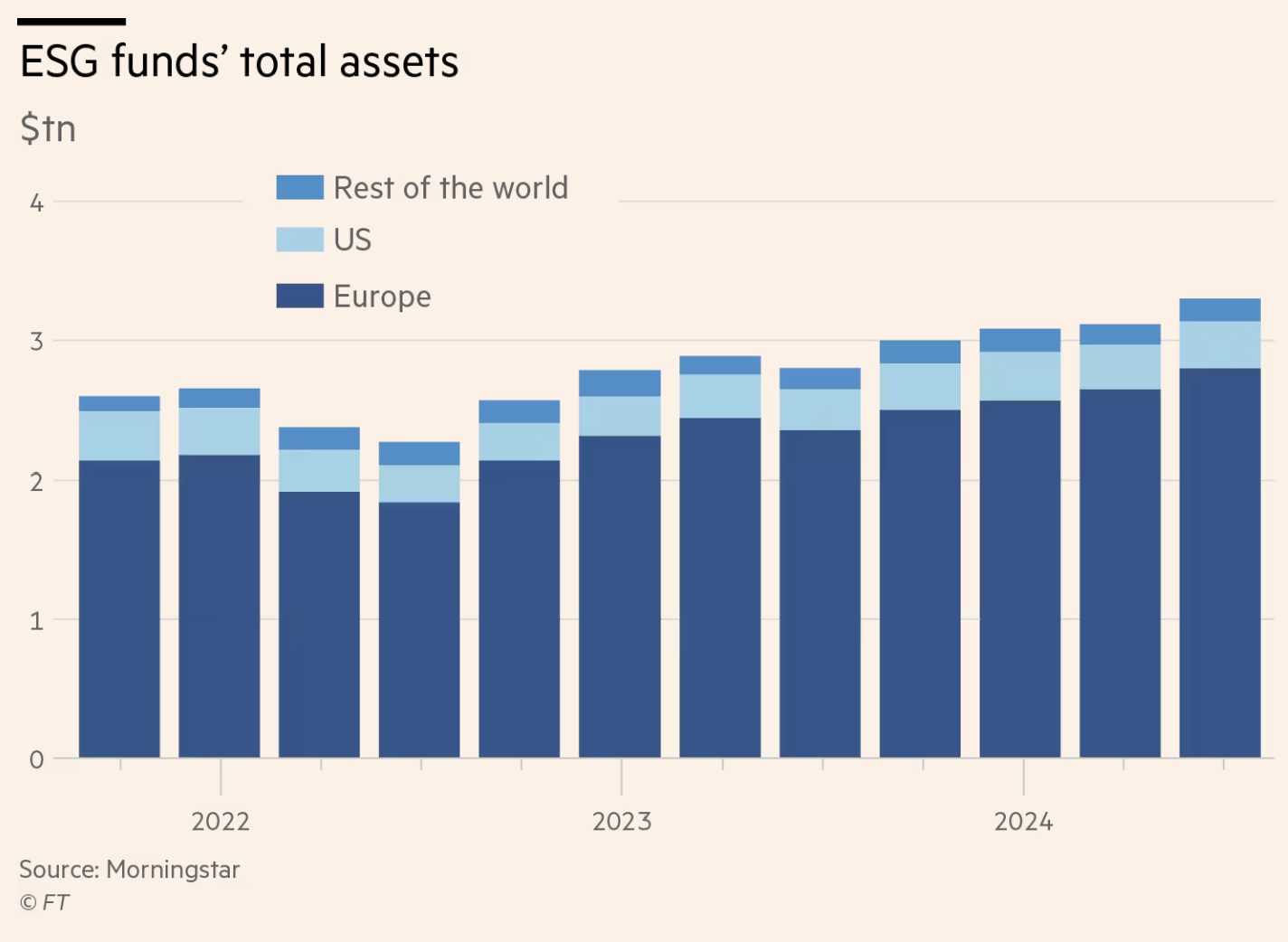

Bonus) Reason to stay optimistic. ESG fund flows remain still strong in Europe, and Europe is where the action is, accounting for 84% of global sustainable funds.

"Europe is the centre of sustainable investment, making up 84 per cent of global sustainable funds, with just 11 per cent in the US, Morningstar data shows. While net inflows into US-based sustainable funds turned negative at the end of 2022, their relatively small share of the market did not lead to net outflows globally, which are held up by continuing inflows in Europe. That means that global asset managers face the problem of threading the needle to satisfy different clients. While Allianz Global Investors remains a member of Climate Action 100+, its US-based subsidiary Pimco withdrew. Similarly BlackRock withdrew from the group, but transferred its membership to its international subsidiary."

(Source: Can sustainable investing survive Trump 2.0? (FT, Jan 17, 2025))